Do You Have College Aspirations? 0

Junior year is your last reprieve before the hectic college admission schedule of senior year begins. Just ask the seniors what this means and they’ll tell you! But you can avoid some of the stress and frenzy by getting organized today.

Junior year is your last reprieve before the hectic college admission schedule of senior year begins. Just ask the seniors what this means and they’ll tell you! But you can avoid some of the stress and frenzy by getting organized today.

As a junior, you can probably see the end of your high school career is near. It might be tempting then to ease up on your schoolwork. This would be a huge mistake. One of the most important factors that colleges take into account is your course selection and grades. Junior year is the time to hit the books hardest. Colleges also place more emphasis on your junior and senior grades than those from previous years.

Junior year is also the second-best time (sophomore is better) for you to begin participating in meaningful extracurricular activities. However, as we said to you before, only get involved in the activities that truly interest you. Try to make a significant contribution to something that you enjoy doing outside of the classroom. It does not have to be school-related either. When colleges look at your activities they want to see the quality of participation, not quantity. This year may also be a good time to drop some of the activities that you really don’t care for and focus on those that you enjoy.

If you’ve never had a meaningful conversation with any of your teachers, now is the time to do so. Focus on building your relationship with your teachers. Next year you will need to ask at least two teachers for recommendations. Ideally, your teachers will be able to not only write about your academic abilities but also about you as a person. So help your teachers get to know you.

Finally, you should also take this time to start collecting and organizing information from colleges. If you have started this process with us, you now have a good list of colleges based on the results of four insightful self-assessments (Personality ~ Natural 9 Intelligences ~ Learning Style ~ Skills) and your personal criteria. Plan to visit colleges during your winter and spring breaks later this year. For now, you can visit colleges on the web using the AAA method to become familiar with what they have to offer and if they have the qualifications to help you reach your goals.

Key Steps to Success 0

A college education has long been viewed as a ticket to a better quality of life. Though it is truly a milestone decision in a young person’s life it does not necessarily mean that a particular college decision will have the highest rate of return in achieving life goals. Unfortunately, some students do not think clearly about this decision, buying the brand name college and taking on large amounts of debt.

A college education has long been viewed as a ticket to a better quality of life. Though it is truly a milestone decision in a young person’s life it does not necessarily mean that a particular college decision will have the highest rate of return in achieving life goals. Unfortunately, some students do not think clearly about this decision, buying the brand name college and taking on large amounts of debt.

For students who don’t want to have daunting repayment obligations, without a solid income opportunity consider this:

- Know the average amount of debt that students carry at each of your potential colleges. Check out college-insight.org for such information.

- Complete a money-saving Dry Run before you even have a final list of colleges in mind.

- Discuss with counselors and advisors what majors to consider and understand how your natural strengths and innate characteristics fit related careers.

- Earn and save money during college. Many bright students are earning over $1000/month part-time while in college without sacrificing their academic responsibilities. Call Eric and he will show you how they are doing it.

“Excessive student debt, often made without an explicit decision on its impact on future life choices, not only restricts traditional career choices but the basic ability of young people to take risks requiring them to defer their dreams,” says Robert Shireman, executive director for the nonprofit Project on Student Debt.

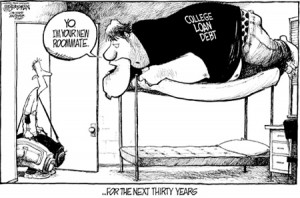

According to the Project on Student Debt, the average 2010 graduate carried $25,250 in loans. (Not to mention what the parents have borrowed.) The big galoot above says to the young graduate, “Yo! I am your new roommate…for the next thirty years.”

Astrid Neilson, a 23-year-old who graduated from the University of Virginia, assumed a huge financial burden to attend a public university as an out-of-state student. Her life is definitely impacted by the $90,000 college debt from the college. (Some were signature loans from a relative.) I really want to go to law school, but can’t unless I get a scholarship. Possible, but not likely.

Neilson did not consider future income before assuming her loans, although she anticipated always working in the nonprofit or public sector. Her choices confirm a recent survey by student-loan provider Sallie Mae that post-graduate income was not a factor for an incredible 70 % of students and parents in determining how much to borrow to finance a college degree. (Can you say Dry Run?)

So after the glossy college brochures arrive in the mail and the visits to leafy college campuses are over, students need to ask themselves: Can I afford this school without excessive borrowing? If money saved falls short, consider living at home for two years, get the necessary pre-requisites out of the way at a community college and transfer to your state or private university. Be smart now and financially independent later.

So after the glossy college brochures arrive in the mail and the visits to leafy college campuses are over, students need to ask themselves: Can I afford this school without excessive borrowing? If money saved falls short, consider living at home for two years, get the necessary pre-requisites out of the way at a community college and transfer to your state or private university. Be smart now and financially independent later.

Do not like that option? Then you should read The Millionaire Next Door.

Real World Preparation 0

Anyone who has ever been on a job interview will tell you, one of the first questions an interviewer will ask is; What kind of experience have you had that has prepared you for the position?

Anyone who has ever been on a job interview will tell you, one of the first questions an interviewer will ask is; What kind of experience have you had that has prepared you for the position?

If you are a recent college graduate and aspire to be employed (for example) as a financial analyst for a growing international company like this one, will you be able to say, Yes, thank you for asking. The two summers, while in college, working for Bain & Company in Boston inspired my decision to work for a company that has strong growth potential not only in the North American market but internationally as well.

Having already done research into the company to which you seek employment, you go on to say, I earned my BA in International Business with an emphasis on economic policy. I am also fluent in both German and Mandarin Chinese, countries in which you do business. The work I did in a collaborative team environment was to analyze the financial reports of companies to determine the areas of strength and weaknesses. We then would make proposals to make the necessary changes to replace the weaknesses with vital improvements for the short and long term.

Or will you be saying to a future employer, (because you did not take advantage of any substantive internships during college). Well, I managed the Trading Post Snack Bar at Camp Tip-A-Canoe in Vermont for two summers. At the end of the summer I showed a profit of at least $194.25 from the sale of all the cookies and candy sold to the campers.

during college). Well, I managed the Trading Post Snack Bar at Camp Tip-A-Canoe in Vermont for two summers. At the end of the summer I showed a profit of at least $194.25 from the sale of all the cookies and candy sold to the campers.

Listen up! It is not too late. There is good news for the current undergraduate here. Internships provide short-term practical experience for students and recent graduates. They may be located anywhere in the world. Check with you college career services office. In fact, a college student should know what that office does starting in the freshman year. Though many internships will be done in the summer following the junior year, the ambitious student will research and apply for one before the end of the sophomore year.

Take a look at what one enterprising student did. She saw a need and filled it! She is now known as the Intern Queen. Learn from her. By the way, you can probably guess what her personality archetype is, can’t you?

Take a look at what one enterprising student did. She saw a need and filled it! She is now known as the Intern Queen. Learn from her. By the way, you can probably guess what her personality archetype is, can’t you?

According to a recent survey by the National Association of Colleges and Employers, employers reported that, on average, more that 3 out of 5 hires had internship experience. Many employers hire directly from their internship programs.

Career counselors, books, and other resources can be helpful in the application and interview process. In fact, if you are an undergraduate or even out of college and still not sure the direction you wish to take, call us at (978) 820-1295. Let’s discuss the options that will save you time and aggravation.

Perfect SAT Scores Can Be a Detriment 0

Students are surprised when I say that a perfect 1600 SAT can sometimes be viewed as ho-hum boring. A score between 1450 and 1550 is a good target for the Ancient 8 and their ilk. They show strong reasoning skills but not nerd-like characteristics. Yes, I know, that could be an incorrect assumption, but the most competitive colleges are looking for students that have something to offer a class other than an ability to ace standardized tests. Strong SAT and ACT scores are expected from every applicant. “What else ya’ got?”

Students are surprised when I say that a perfect 1600 SAT can sometimes be viewed as ho-hum boring. A score between 1450 and 1550 is a good target for the Ancient 8 and their ilk. They show strong reasoning skills but not nerd-like characteristics. Yes, I know, that could be an incorrect assumption, but the most competitive colleges are looking for students that have something to offer a class other than an ability to ace standardized tests. Strong SAT and ACT scores are expected from every applicant. “What else ya’ got?”

Here are the top 10 things admission committees want to see in an applicant. Number five on that list is Well Written Essays also called the “Personal Statement”. Of course, a strong GPA, challenging courses, one or two extracurricular activities in which you have demonstrated serious interest and/or leadership, honors, and teacher recommendation letters are very important factors. But only the latter and the essays say (or should say) something about the student’s personality.

The college essay is the only time the admissions folks get to hear from the student directly in his or her own voice. For most of us, writing is a chore and one of those things that we put off. Particularly in this day and age of twitter, text messaging, 30 second sound bites, and other mindless distractions. We look at the task of sitting down and thoughtfully putting ideas on paper as agony and time that could be spent on more important things like Facebook.

I know, because I have been there. It is like a giant Black Hole from which there is no escape. But I am also here to tell you that once you gather the strength, clear your head and quiet your mind you will be very pleased with yourself once the job is done.

So, if you are faced with that task and have not yet started, yesterday would be a good time to start. Follow the tips at the links above and set aside the same time each day to write. Remember, even the most famous authors had to write and rewrite several times before they were finished. Even after they thought their job was done, they needed an editor to read the draft and make suggestions and correct grammatical errors.

In other words, you will need time to do it right. Call us if you want to brainstorm some topic ideas or other help. We still have time to help before a black hole sucks us back in.

How They Look at You 0

What does need blind mean? and If I say I will not be applying for financial aid help me get accepted? are questions often asked. To the first question, a college would say it means We do not consider the financial need of an applicant when considering his or her qualifications for admittance. In fact, most all most competitive colleges describe their admissions policies as holistic. They look at the grades, test scores, essays, recommendations, activities but not the financial need.

What does need blind mean? and If I say I will not be applying for financial aid help me get accepted? are questions often asked. To the first question, a college would say it means We do not consider the financial need of an applicant when considering his or her qualifications for admittance. In fact, most all most competitive colleges describe their admissions policies as holistic. They look at the grades, test scores, essays, recommendations, activities but not the financial need.

But I say buyers beware.

To the second question, the answer is no. All families should at least file the FAFSA form. See how financial aid really works here. Though you may have found out that your eligibility of “need based” aid is not possible, circumstances could change either because of younger siblings nearing college age or loss of income. At a College Board seminar I attended, one FAO at an elite private confided in me that if a family doesn’t complete at least the FAFSA prior to freshman year…the chances of receiving aid later would be “highly unlikely”. So, the student can still claim “no” in response to the application question “Will you be applying for financial aid?” But fill out the FAFSA…not the Profile.

There are distinct patterns, typically not known by applicants that differentiate some holistic colleges from others. Most colleges focus entirely on academic qualifications first, and then consider other factors. But some colleges focus first on issues of fit between a college’s needs and an applicant’s needs.

Every college has a unique way of looking at a student. Most common among liberal arts colleges and some of the most competitive private universities, results in a focus on non-academic qualities of applicants, and tends to favor those who are members of minority groups underrepresented on campus and those who can afford to pay the full cost of attendance or COA.

most competitive private universities, results in a focus on non-academic qualities of applicants, and tends to favor those who are members of minority groups underrepresented on campus and those who can afford to pay the full cost of attendance or COA.

Rachel B. Rubin, a doctoral student in education at Harvard University did extensive research of about 75 elite colleges and universities. Her findings are summarized in Inside Higher Education.

Her research concentrated on the most competitive colleges that admit small percentages of their applicants and that generally say the vast majority of applicants are capable of succeeding academically.

I smile when I recall the picture drawn by the Dean of Admissions and Financial aid of Harvard, Bill Fitzsimmons at a College Board admissions workshop I attended. He said with over 32,000 applications every year (most very qualified applicants), it was a tough task. But once they winnowed the pile down to the last 6500 applications, he said this: We could just as well have thrown all 6500 files out the window on to Harvard Yard and admit the first 1800 we picked up. That would give us a perfectly diversified and talented freshman class. At least now it is decidedly more diverse than it was in the late 1880’s.

Speaking of Mr. Fitzsimmons, here are five questions that he responded to in an interview in 2009. The answers are an accurate depiction of Harvard’s policy and philosophy today.

Speaking of Mr. Fitzsimmons, here are five questions that he responded to in an interview in 2009. The answers are an accurate depiction of Harvard’s policy and philosophy today.

A History Lesson 0

You cannot solve a problem with the same thinking that created the problem.

That quote has been attributed to Albert Einstein. I am not sure in what context he said that, but when it comes to the current escalation of student and parent debt, there could be a lesson to be learned. One does not have to look far to recognize that there is a problem. To solve the problem, therefore, we must NOT rely on the same thinking by the people (or institutions) that created the problem.

That quote has been attributed to Albert Einstein. I am not sure in what context he said that, but when it comes to the current escalation of student and parent debt, there could be a lesson to be learned. One does not have to look far to recognize that there is a problem. To solve the problem, therefore, we must NOT rely on the same thinking by the people (or institutions) that created the problem.

When the world was getting back on its feet following World War II there was huge expansion in the US economy. As in WWI, the nation was not subject to the civilian genocide and property destruction in Europe, Asia and elsewhere. We were seen as the leader of the western world.

In fact, in July of 1944, 760 delegates from 44 countries met in Bretton Woods, New Hampshire at the Mt Washington Hotel to set monetary policy for the civilized world. The delegates agreed upon a monetary policy that set the US dollar (backed by gold and silver), as the standard for world currency. From that event came the International Monetary Fund (IMF) and the system of exchange rate management was set up.

That system stayed in place until the country overspent during the “guns and butter” decade of the 60’s. The decision was made to take the dollar off the gold standard in 1971. Watch this short historic video when President Nixon announced that action. That marked a significant issuance of fiat currency (money created out of thin air) by the Federal Reserve, a devaluation of the dollar and ever-increasing debt.

I know it may be a fantasy of mine, but I suggest that we teach basic money management in every high school. Many students who major in economics in U.S. colleges do not even understand the exponential value of money. Nor do they know as much as this bright 12 year old has already learned in Canada. I once interviewed a graduate of Harvard for a management position I had. He majored in Economics and when I asked him if he could explain the Rule of 72 as it relates to money, he did not know what I was talking about!

The problem is that we are a society that does not save, we spend. Saving, not spending grows the economy. This is not what we are taught in school. Believing that a college education is a right (or even a necessity) is putting our kids into debt. If college is the next milestone step in a teenager’s life, he or she should understand how that financial decision will impact his or her future. So many college graduates have the rule of 72 working against them rather than for them. Over the last 25 years I have watched college costs escalate at higher than the rate of inflation. As the federal and state governments made more grants and loans available for colleges to use to fill a family’s financial need, the faster college costs went up.

The ONLY college that saw the insanity of what the governments were doing and did something about it, was Grove City College in Pennsylvania. But they had to go all the way to the Supreme Court of the United States to fight and maintain their independence! Unbelievable. Only two other colleges to my knowledge followed their example and the principles of sound economics.

The ONLY college that saw the insanity of what the governments were doing and did something about it, was Grove City College in Pennsylvania. But they had to go all the way to the Supreme Court of the United States to fight and maintain their independence! Unbelievable. Only two other colleges to my knowledge followed their example and the principles of sound economics.

Pop Quiz! Name those two colleges and I will send you in US currency what a dollar is worth in gold.

Therefore, in order to get out of this looming debt crisis, we have to teach our kids real financial literacy beyond how to balance a check book and not rely on government for solutions to an economic challenge including paying for college.

“Houston…We Have A Problem.” 0

That cryptic phrase was the actual message sent by Astronaut, Jack Swigert on April 13, 1970, to NASA Mission Control in Houston, Texas. As you will see here, it was definitely a problem. The rocket was over 200,000 miles from earth and heading toward the moon when an huge explosion occurred on board. The process by which the rocket was turned around using brilliant engineering tactical skills resulting in a successful return back to planet Earth was miraculous.

That cryptic phrase was the actual message sent by Astronaut, Jack Swigert on April 13, 1970, to NASA Mission Control in Houston, Texas. As you will see here, it was definitely a problem. The rocket was over 200,000 miles from earth and heading toward the moon when an huge explosion occurred on board. The process by which the rocket was turned around using brilliant engineering tactical skills resulting in a successful return back to planet Earth was miraculous.

The question is: Does America have the brainpower today to meet such challenges?

Now that I have your attention, let us consider the problem. The immediate problem we have has to do with the lowering of academic standards in our schools (and colleges) over the last 40 years. What kind of preparation do high school students get for college or for life in general, for that matter?

More and more American colleges have incoming freshmen that are flat out not prepared for college-level work. Even professor’s at the most competitive Ivy League schools see the diminishing writing, reading, and critical thinking skills their students have. Why is that?

For an in-depth answer to that question, you can read the insightful, exhaustive, and extensive research by Charlotte Iserbyt. Her tome, The Deliberate Dumbing Down of America is where to start.

There is a myriad of good solutions to the problem. But like most things, it will need a consensus that there is a problem and an interest in the solutions. A teacher’s ability to teach is obviously important. But teaching a classroom of diverse personalities is not easy. It takes a special person who has the passion and ability to teach and inspire effectively. As I talk with high school students, I learn that their interest in various subjects often depends upon the teacher’s ability to engage and motivate them. It may not even be a subject they had an interest in before taking the class. Are you a student? Is that true?

Another challenge that principals and superintendents have is that school systems are required to meet the state and federal rules and regulations of the Departments of Education. Ms. Iserbyt does an excellent job of pointing out the problems there. Do you think that the government may have overreached and put both the teachers and students at an extreme disadvantage?

Parents should learn if the curriculum being taught is what the student needs to learn. Is it time to ABOLISH the Federal Department of Education and return education planning to the states, and more importantly the school districts? Admittedly, it will be extremely tough because most school administrators and parents have gone through the indoctrination that needs to be changed. But the interview here is where to not only see the problem but how to solve it.

In the final analysis, isn’t learning a lifelong activity? As Saint Augustine once wrote, “The world is a book, and those who do not travel, read only one page. Think about how you can leave the world better than you found it when you arrived. (Email or call for the password.)

The Changing Landscape 0

The relationship between the financial aid and admissions offices has changed over the years. Only a few colleges are still NOT need sensitive and are genuinely need blind when making their admissions decisions.

The relationship between the financial aid and admissions offices has changed over the years. Only a few colleges are still NOT need sensitive and are genuinely need blind when making their admissions decisions.

Unfortunately for the vast majority of college bound high school students, those are private schools that are extremely competitive such as Harvard, Yale and Princeton. There are about 50 colleges that still have enough cash in their budgets to fill a student’s need 100%.

Of course, the definition of need is the individual school’s (not your) interpretation of need. That is why we recommend every family complete a money-saving Dry Run years before a student even applies to a college. It is not necessary to have a final, or even preliminary list to do this exercise.

One of the first questions families used to ask when looking at a college was, “What are our chances for acceptance? (That was always an interesting way to ask it because one would think that the parent was also applying.) With the ever increasing cost of colleges that use government loans and grants to fill their aid packages, more parents are concerned about the cost and the first questions include Can I afford it?”

While admissions officers are well versed in SAT-score and GPA requirements for their institutions, it is now crucial that they know how to answer questions about eligibility for financial aid and merit scholarships. Although many admissions deans say they have always worked in close collaboration with their financial-aid offices, such efforts are becoming more critical as colleges tweak their aid policies and packaging to attract accepted students.

Various surveys and my conversations with admissions officers reveal that monetary issues weigh heavily on their minds. That concern is not shared with prospective students during the college tour. When asked which activities were most time-consuming, admissions officers ranked “communicating with other campus offices,” particularly the financial-aid office, the highest, with 70 percent reporting that they spend a “high” or “very high” amount of time on that activity. More than a dozen admissions deans interviewed by The Chronicle of Higher Education affirmed that statistic, saying they were in daily contact with their financial-aid colleagues.

Various surveys and my conversations with admissions officers reveal that monetary issues weigh heavily on their minds. That concern is not shared with prospective students during the college tour. When asked which activities were most time-consuming, admissions officers ranked “communicating with other campus offices,” particularly the financial-aid office, the highest, with 70 percent reporting that they spend a “high” or “very high” amount of time on that activity. More than a dozen admissions deans interviewed by The Chronicle of Higher Education affirmed that statistic, saying they were in daily contact with their financial-aid colleagues.

To ensure that both admissions staffers and financial-aid professionals have the same understanding of their college’s enrollment goals, many institutions have enlisted enrollment managers to oversee both offices and act as a liaison between the two. At smaller colleges, where adding more staff members might not be feasible, it has become more common for the role of admissions dean and financial-aid director

As we enter the second half of the school year and high school sophomores, juniors and some seniors schedule April visits, find out a prospective colleges financial aid methodologies. In fact, ask us for the 7 Questions to ask Financial Aid Administrators. This will smooth the way to that conversation. Having a congenial Q & A with the FAO now, could pay off in the end. Remember, most financial aid officers have your best interests in mind, but they are also subject to the school’s policies. We can help you learn what they are beforehand. Call us today.

The Dreaded Wait List 0

Being placed on the college wait-list is not uncommon these days. If that happens, the college should provide a history that describes the number of students on the wait-list and how many have been selected from it in the past, as well as the availability of financial aid and housing. Because of the enormous increase in applications, more colleges are putting well qualified students on the wait-list.

But there are other reasons. It is sometimes because those strong students have not shown enough evidence that demonstrates to the admissions folks that he or she is seriously interested in their college. One giveaway is when a student applies to a cluster of schools that are not related to one another, or maybe in the same athletic league but culturally quite separate. Brown and Dartmouth are both very competitive Ivy League colleges but quite different in educational philosophy and culture.

In guiding our students through this process, we go over the strategies to avoid this perception and outcome. In fact, I probably become quite tiresome in my continual emphasis on the AAA method of due diligence. But it works. The students who take the few minutes to collect this information have no regrets.

Finally, if you are placed on a wait-list and genuinely want to go to that college, let them know in writing.  Provide them with another recommendation and your latest spring grades. Follow their policies, however. But if you have had some good communication with the regional admissions representative at that college, now is the time to reconnect. Talk to him or her for suggestions.

Provide them with another recommendation and your latest spring grades. Follow their policies, however. But if you have had some good communication with the regional admissions representative at that college, now is the time to reconnect. Talk to him or her for suggestions.

Colleges will often say they do not have a priority pecking order from the wait-list, but play it safe and you will be in a better position by making it clear that you will attend if accepted.

The Mail Box Never Gets More Attention… 0

Just when spring fever sets in college applications are piled high in admissions offices across the country the pressure mounts. It is not just in those offices either. All college bound seniors are watching their snail mail and email daily. Some have heard already. You can tell who they are by their body language in the hallways. If you are a student you know what I mean.

Some of the most selective colleges no longer adhere strictly to the common notification of April 1. In the last few years they are trying to get a jump on their competition by unofficially admitting a percentage of the stronger candidates around March 15. Dartmouth College, for instance, may send out selected early notification of future admission letters to some strong applicants in February.

With a head start, these colleges can put psychological pressure on a young scholar to accept their offers of admission, as tentative as they may be. If this happens to you, be cautious and do not rush to send in your deposit. You have until May 1 to do that. Now is the time to evaluate ALL the colleges to which you gain acceptance one final time to see if they are qualified to serve you. You have already proved that you are qualified to be a future student there.