3. Graduate category archive

Now What? 0

Now What? That is the title of a book by Ari King, in 2009 he was an unemployed graduate of Wesleyan University with a $180,000 degree in Italian Studies. He spent the summer after graduation at his home in California thinking about what to do with his life. At summer’s end, with no job prospects, he headed to New York City thinking his opportunities would be better in a town with 8.4 million people.

Now What? That is the title of a book by Ari King, in 2009 he was an unemployed graduate of Wesleyan University with a $180,000 degree in Italian Studies. He spent the summer after graduation at his home in California thinking about what to do with his life. At summer’s end, with no job prospects, he headed to New York City thinking his opportunities would be better in a town with 8.4 million people.

A friend who was a senior at NYU offered him a place to stay with his five roommates. It was deja vu all over again, but now with six roommates, not one. Sleeping bags come in handy in the city when there isn’t a couch available.

Each day he would scour Craigslist and elsewhere, looking for jobs under every category from ˜Government” and ˜Education” to ˜Russian speaking Nanny” to ˜Security Guard”. He grew increasingly frustrated, with a gnawing feeling of defeat and anxiety. Even hospitality jobs, where a decent income from tips could be quite good, were scarce. Once a person landed such a job, they didn’t leave. With the unprosecuted malfeasance on Wall Street, everyone was playing it safe.

His real world wake-up call reaffirmed what I have been seeing for the last 25 years. Too many colleges, for one reason or another, do not prepare their students to bridge the gap from college to the real world very effectively. Of course, we cannot put the blame entirely on colleges. That is why I tell high school students that it is their responsibility to thoroughly research the advising and career services of the colleges they are considering. It is the all-important third A in the AAA process. Plus, they must become a familiar face and known to the personnel in the career services offices no later than the second semester of freshman year. After all, what is college for?

Now, because of the latest pandemic (remember this one?) many people are unemployed or underemployed, not just recent college graduates. What does one do when one can’t get a job? Some may say, keep looking; don’t quit! Easy for them to say. But there is one thing that many bright people with initiative (college degree or not) are realizing; that if you can’t find a job or don’t like the one you have, create one!

But first, you have to look within yourself and identify honestly what you are good at. Ask yourself if you can use that natural strength to not only meet a need that people have but will pay you to fill it. For instance, Ari King enjoyed writing and his teachers recognized he had a flair for writing. He looked around his world. Why not write a guidebook that will help college students prepare for life after college? He did not see many that addressed the issue. He thought “Would people be interested?” The answer, judging by these Amazon reviews, is yes!

While reading his book I was amazed at the majority of college graduates he interviewed who went to college with little thought put into how they were going to live and pay bills after college. Each graduate was asked what regrets he or she had and what could have been done differently. The majority said they did not use the career services office early enough (or at all) to find internships. No wonder so many were jobless upon graduation or working in jobs that a high school graduate would be qualified to do.

little thought put into how they were going to live and pay bills after college. Each graduate was asked what regrets he or she had and what could have been done differently. The majority said they did not use the career services office early enough (or at all) to find internships. No wonder so many were jobless upon graduation or working in jobs that a high school graduate would be qualified to do.

I recommend the book Now What? and encourage all students thinking about college or in college now to read it this summer before they realize that the years in college are a waste of time and money. Contact us if you REALLY want to make sure college is a good investment as well as learn how to keep yourself healthy during these challenging times…and beyond!

Good News for the Undergraduate 0

For 29 years I have been encouraging college students to take full advantage of their college’s advising services. (Get your free gift below,) This includes professor mentoring, internships, and the Career Planning Services office. One does not have to look very far to learn that many college graduates are leaving college with student loans and few job prospects much less any related to their chosen major.

Now, with the current challenges stemming from the global pandemic based on a virus strain of the common Coronavirus family from which over 99% of healthy humans are either immune or can recover with proper nutritional care provided by a true healthcare professional who understands the innate power of the human immune system. Pandemics have regularly occurred over the years, remember this one? In any case, it is all that more important that we plan how we will earn a living providing for our families and serving others in our communities where governments have temporarily restricted one’s movements by means of edicts and/or mandates.

Yes, on the surface it may not bode well for the current undergrad. However, there are steps that both the student and the college can take to brighten that outcome. I was very encouraged before colleges went to “remote learning” when I saw the attention given to sophomores at some colleges during the annual ritual of newly minted college freshmen saying goodbye to parents.

It is encouraging to see more and more colleges taking their role as advisors more proactively. For instance, look at Lafayette College’s website. They are not hesitating to open their books to prospective students with information as to what past graduates have been able to accomplish.

If you are a recent graduate or parent, and considering doing something new, here are two resources I can confidently recommend. They can work with you wherever you call home. 🙂

1. Kim Meninger, MBA, a very intuitive Executive Coach and Career Strategist. Take your first step here.

2. Joanne Meehl Career Services offers terrific tips on her Blog and one on one counseling.

If you are a college student, how much research into the advising and internship options have you done? If little, start to familiarize yourself with the career services office, even if you are a freshman. By the way, one student who took the matter of interning VERY seriously has turned her experience into a business. Meet Lauren Berger, the InternQueen.

Once the freshman year has been successfully navigated and you know what is expected academically, it is now time to really get serious and think about why you are in college.

The passing of Steve Jobs reminded me of his 2005 graduation talk to Stanford graduates. It is without a doubt, one of the finest commencement speeches ever delivered in history! Here is the life-changing message. Think about what he said. For me, it was one of the most insightful and spiritually aware statements of purpose I have ever heard. Let me know what you think?

Speaking of “insightful” if you have done your four (4) insightful self-assessments with us, do not forget they reveal within them a rich resource of career descriptions and academic concentrations that are matched up to your individual natural strengths and innate characteristics that will comprise your personality for your life on this planet we call Earth!

It is literally at your fingertips for years to come. Take advantage of that. If you have not bookmarked the link, I will send you the link. In addition, if you have any questions regarding your choice of major, send me an email ~ help@SmartCollegePlanning.org

Finally, all undergrads (or grads) that complete our undergraduate survey here by July 15, 2023 (in celebration of our 30th Anniversary) my gift to you will be the book The Secret to Getting a Job After College. (Or another one of your choice.) We look forward to hearing how you are doing now and what you plan to do going forward.

Generations 0

Fifteen years ago two professors at Beloit College in Wisconsin published a list of observations they determined to be characteristic of the entering freshman that would be graduating in 2002. It went viral soon after that and became a greatly anticipated annual event in certain academic circles. It is funny, it is eye-opening and it is scary!

Fifteen years ago two professors at Beloit College in Wisconsin published a list of observations they determined to be characteristic of the entering freshman that would be graduating in 2002. It went viral soon after that and became a greatly anticipated annual event in certain academic circles. It is funny, it is eye-opening and it is scary!

For instance, if you were born post 1995, having a chat seldom involved talking. Java has never been just a cup of coffee; the US has always imposed economic sanctions against Iran; you never attended a concert in a smoke filled arena and rights of passage had more to do with when you got your own cell phone or Skype account than getting a drivers license or car.

The list that will characterize the high school Class of 2014 (that will graduate college in 2018) has not been released yet, but if it will be as terrifying as last years. YIKES!

What an interesting sociological study of the ever changing generational changes.

As a student of a certain era, I look back and reminisce from time to time. It is fun to do that isn’t it? I know that social scientists have put labels on various populations since the twenties.

In what year were you born? How well do you fit within that period of that time?

- 1928 to 1945 ~ The Silent Generation (Some might say the greatest.)

- 1946 to 1964 ~ The Baby Boom Generation

- 1965 to 1980 ~ Generation X

- 1981 to 2002 ~ The Millennial Generation

Now, it may be easy to place yourself into one of those chronologically but if you want to know how you truly fit in a particular generation, I suggest you take the 14 question POP quiz below. 🙂

I took it and found it uncannily accurate. Find out for yourself here.

Presently, all of our students are part of the Millennial Generation and most (but not all) of their parents are Generation X. Holy coffin nails Batman! None of them were alive when JFK was killed. Do they even know what JFK was planning on doing as President? How much have they learned about history in AP History? I hope more than I think based on the annual survey below.

Are you ready for this? Of course you are. Let me know what you think you could add to the list.

Crossing the Gap ~ Preparing for the Transition 0

In the post WW II era of the early 50’s there were approximately 3 million college students; now there are 20 million. A college degree which used to be seen as a luxury, something which would, in a lifetime, enrich and enlighten….is now seen as a ticket to a bigger paycheck. Colleges, supported by the College Board and politicians in the District of Columbia, continue to say that a Bachelor degree is worth over 1.3 million dollars more in earnings than a high school diploma. Look at the report published by Georgetown University’s Center on Education and the Work Force.

In the post WW II era of the early 50’s there were approximately 3 million college students; now there are 20 million. A college degree which used to be seen as a luxury, something which would, in a lifetime, enrich and enlighten….is now seen as a ticket to a bigger paycheck. Colleges, supported by the College Board and politicians in the District of Columbia, continue to say that a Bachelor degree is worth over 1.3 million dollars more in earnings than a high school diploma. Look at the report published by Georgetown University’s Center on Education and the Work Force.

But now we hear that the undergraduate degree is not enough and that an increasing number of graduates are unemployed or underemployed. If that is true, why is it true?

But now we hear that the undergraduate degree is not enough and that an increasing number of graduates are unemployed or underemployed. If that is true, why is it true?

- Are employers raising the proverbial bar for advancement or even entry level jobs within the organization?

- Is it because colleges are graduating students with little more knowledge or critical thinking skills than they had in high school ?

- Or is it because college graduates are not prepared to enter the work force because they have had little or no substantive work experience while they were college students?

Many would blame the “economy”. Yes, we hear a lot in the news about jobs being scarce because of the great recession. But we are not told why. I suggest it is because our Keynesian economic system, based on fiat currency and debt, has been subtlety used to manipulate trends of booms and busts in the economy since 1913 and was accelerated in 1971 when the dollar was taken off the gold standard. Currently, there is statistical evidence that the graduating college and high school class of 2013 continue to face dim job prospects. It is one of the symptoms of the excess borrowing and inflationary spending.

Despite that reality check, there is good news for the undergraduates here. 🙂

Newly minted college graduates (and parents) have made significant down payments on their futures in terms of both time and money, and they typically have a considerable burden of debt right out of the gate. If that graduate did not investigate the career services department beginning in the freshman year (preferably when they were still in high school) he or she may have missed getting the internship or co-op experience needed to optimize employment prospects.

Newly minted college graduates (and parents) have made significant down payments on their futures in terms of both time and money, and they typically have a considerable burden of debt right out of the gate. If that graduate did not investigate the career services department beginning in the freshman year (preferably when they were still in high school) he or she may have missed getting the internship or co-op experience needed to optimize employment prospects.

If you are an undergraduate now or thinking about going to college, look around your community. Is there something you see that is being done (legally) 🙂 by someone that not only looks interesting but enjoyable and …dare I say fun? Though you may not be able to tell at first, are they earning an income that supports their life style?

Take an honest assessment of your natural strengths and innate characteristics. (If you have done that work with me already, return to the computer where you have made it a favorite.) Research that work that looks like fun and learn what it will take to do it. By the way, did you know that the best definition of workis NOT in the dictionary? Here it is.

Work (wurk) n. ˜something you do when you would rather be doing something else”

Is that a Utopian ideal? Not necessarily.

If you are a whiz in math or science that does not mean you should be an engineer, mathematician or doctor. Your peers, relatives and teachers may say so, and they may be right. But I don’t have enough fingers and toes to count the number of adults I know who are now self-employed with time freedom to spend doing things they never dreamed they could do and spend time with their families all while writing their own paycheck. The work they are doing may even be unrelated to what their college major was. Learn from the learning curve of adults and college students like these who have walked the path ahead of you and changed their destinies by focusing on doing, not wishing.

If you cannot find your dream job why not create one! As a matter of fact, forget about a job for a moment. After all, did you know that JOB is an acronym for Just Over Broke. Jim Rohn, the late great business philosopher and mentor for millions of successful entrepreneurs said, “Formal education can help make you a living, but self-education will make you a fortune.”

He was a master with words and ‘walked the talk’ by doing. We ALL have the ability to change, but as Jim Rohn said in another memorable quote, “If you really want to do something, you will find a way; if you don’t you will find an excuse. If you would like some help or simply assurance that you are on the right track, give us a call. No more excuses. 🙂

Eric Goodhart ~ (978) 820-1295

What is College For? 0

As we enter the second semester of the academic year, millions of high school students are anxiously awaiting college acceptance letters. Some have heard already from those colleges. The students who applied in a college’s ED, EA or rolling admissions program. But the most competitive colleges will not make their final decisions until late March for the RA pool of applications.

As we enter the second semester of the academic year, millions of high school students are anxiously awaiting college acceptance letters. Some have heard already from those colleges. The students who applied in a college’s ED, EA or rolling admissions program. But the most competitive colleges will not make their final decisions until late March for the RA pool of applications.

Other than those students who were accepted in December in an ED program, all other students will have until May 1 to make their final decisions. Before that deadline it is the colleges that will be nervous. That is, who will say Yes, I am accepting your acceptance back to them! In the college ratings game made popular by US News & Reports, the higher the yield the higher the ranking.

Yes, it is an exciting time. But let’s step back a minute and consider this. What is college for anyway? Is it REALLY worth the expense? Colleges will tell you it is an investment. But in financial jargon an investment is made in anticipation of an outcome greater than the time or money put into it. Is that what the outcome is in the majority of cases?

In May of 2011, the Pew Research Center released surveys that indicate that 57% of Americans feel that universities in the US fail to provide good value for the money spent. College has always been expensive but in the last 21 years I have seen an escalation of costs that are way out of proportion with income, with one significant exception. Parents view college price tags with a wary eye, as they should. According to the survey only 35% of the American adult public said colleges were doing a good job in terms of providing value to students; 42% said only fair and 15% said poor. In the same survey, however, 84% of recent college graduates said college had been a good investment; only 7% said it had not been.

Why the disparity in belief? Is that because young people don’t want to admit the four years plus they spent in college was money (more often a parent’s money) not well spent? What I sense some of them saying is that the benefits they received are intangible, immeasurable and not connected to what a particular degree got them.

Hopefully, as teenagers mature through their twenties they develop a fair amount of critical thinking and social networking skills. They will benefit greatly from learning as much, if not more, outside the classroom as in it. That is why I put a great deal of emphasis on understanding the nature and depth of academic and career advising at each college they are considering. The student who is pro-active in pursuing internships as an undergraduate often has an advantage amongst his peers following graduation.

Call us at Programs for Education for a complimentary get acquainted conversation. Learn how you and your children can get the best return on investment from their college experience.

Real World Preparation 0

Anyone who has ever been on a job interview will tell you, one of the first questions an interviewer will ask is; What kind of experience have you had that has prepared you for the position?

Anyone who has ever been on a job interview will tell you, one of the first questions an interviewer will ask is; What kind of experience have you had that has prepared you for the position?

If you are a recent college graduate and aspire to be employed (for example) as a financial analyst for a growing international company like this one, will you be able to say, Yes, thank you for asking. The two summers, while in college, working for Bain & Company in Boston inspired my decision to work for a company that has strong growth potential not only in the North American market but internationally as well.

Having already done research into the company to which you seek employment, you go on to say, I earned my BA in International Business with an emphasis on economic policy. I am also fluent in both German and Mandarin Chinese, countries in which you do business. The work I did in a collaborative team environment was to analyze the financial reports of companies to determine the areas of strength and weaknesses. We then would make proposals to make the necessary changes to replace the weaknesses with vital improvements for the short and long term.

Or will you be saying to a future employer, (because you did not take advantage of any substantive internships during college). Well, I managed the Trading Post Snack Bar at Camp Tip-A-Canoe in Vermont for two summers. At the end of the summer I showed a profit of at least $194.25 from the sale of all the cookies and candy sold to the campers.

during college). Well, I managed the Trading Post Snack Bar at Camp Tip-A-Canoe in Vermont for two summers. At the end of the summer I showed a profit of at least $194.25 from the sale of all the cookies and candy sold to the campers.

Listen up! It is not too late. There is good news for the current undergraduate here. Internships provide short-term practical experience for students and recent graduates. They may be located anywhere in the world. Check with you college career services office. In fact, a college student should know what that office does starting in the freshman year. Though many internships will be done in the summer following the junior year, the ambitious student will research and apply for one before the end of the sophomore year.

Take a look at what one enterprising student did. She saw a need and filled it! She is now known as the Intern Queen. Learn from her. By the way, you can probably guess what her personality archetype is, can’t you?

Take a look at what one enterprising student did. She saw a need and filled it! She is now known as the Intern Queen. Learn from her. By the way, you can probably guess what her personality archetype is, can’t you?

According to a recent survey by the National Association of Colleges and Employers, employers reported that, on average, more that 3 out of 5 hires had internship experience. Many employers hire directly from their internship programs.

Career counselors, books, and other resources can be helpful in the application and interview process. In fact, if you are an undergraduate or even out of college and still not sure the direction you wish to take, call us at (978) 820-1295. Let’s discuss the options that will save you time and aggravation.

A History Lesson 0

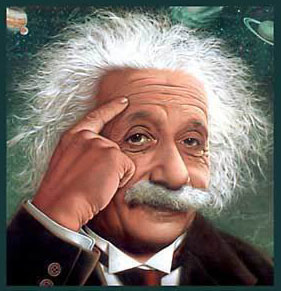

You cannot solve a problem with the same thinking that created the problem.

That quote has been attributed to Albert Einstein. I am not sure in what context he said that, but when it comes to the current escalation of student and parent debt, there could be a lesson to be learned. One does not have to look far to recognize that there is a problem. To solve the problem, therefore, we must NOT rely on the same thinking by the people (or institutions) that created the problem.

That quote has been attributed to Albert Einstein. I am not sure in what context he said that, but when it comes to the current escalation of student and parent debt, there could be a lesson to be learned. One does not have to look far to recognize that there is a problem. To solve the problem, therefore, we must NOT rely on the same thinking by the people (or institutions) that created the problem.

When the world was getting back on its feet following World War II there was huge expansion in the US economy. As in WWI, the nation was not subject to the civilian genocide and property destruction in Europe, Asia and elsewhere. We were seen as the leader of the western world.

In fact, in July of 1944, 760 delegates from 44 countries met in Bretton Woods, New Hampshire at the Mt Washington Hotel to set monetary policy for the civilized world. The delegates agreed upon a monetary policy that set the US dollar (backed by gold and silver), as the standard for world currency. From that event came the International Monetary Fund (IMF) and the system of exchange rate management was set up.

That system stayed in place until the country overspent during the “guns and butter” decade of the 60’s. The decision was made to take the dollar off the gold standard in 1971. Watch this short historic video when President Nixon announced that action. That marked a significant issuance of fiat currency (money created out of thin air) by the Federal Reserve, a devaluation of the dollar and ever-increasing debt.

I know it may be a fantasy of mine, but I suggest that we teach basic money management in every high school. Many students who major in economics in U.S. colleges do not even understand the exponential value of money. Nor do they know as much as this bright 12 year old has already learned in Canada. I once interviewed a graduate of Harvard for a management position I had. He majored in Economics and when I asked him if he could explain the Rule of 72 as it relates to money, he did not know what I was talking about!

The problem is that we are a society that does not save, we spend. Saving, not spending grows the economy. This is not what we are taught in school. Believing that a college education is a right (or even a necessity) is putting our kids into debt. If college is the next milestone step in a teenager’s life, he or she should understand how that financial decision will impact his or her future. So many college graduates have the rule of 72 working against them rather than for them. Over the last 25 years I have watched college costs escalate at higher than the rate of inflation. As the federal and state governments made more grants and loans available for colleges to use to fill a family’s financial need, the faster college costs went up.

The ONLY college that saw the insanity of what the governments were doing and did something about it, was Grove City College in Pennsylvania. But they had to go all the way to the Supreme Court of the United States to fight and maintain their independence! Unbelievable. Only two other colleges to my knowledge followed their example and the principles of sound economics.

The ONLY college that saw the insanity of what the governments were doing and did something about it, was Grove City College in Pennsylvania. But they had to go all the way to the Supreme Court of the United States to fight and maintain their independence! Unbelievable. Only two other colleges to my knowledge followed their example and the principles of sound economics.

Pop Quiz! Name those two colleges and I will send you in US currency what a dollar is worth in gold.

Therefore, in order to get out of this looming debt crisis, we have to teach our kids real financial literacy beyond how to balance a check book and not rely on government for solutions to an economic challenge including paying for college.