Searching for that Perfect College? 0

The perfect college doesn’t exist. Almost any college, whether it’s an Ivy or a local community college, can be the foundation for productive and enjoyable college years. Every student’s experience has its ups and downs. Your parents may know what I mean. With colleges putting so much effort into diversification in recent years, few students fit the cookie-cutter images that proliferate in college view books.

The perfect college doesn’t exist. Almost any college, whether it’s an Ivy or a local community college, can be the foundation for productive and enjoyable college years. Every student’s experience has its ups and downs. Your parents may know what I mean. With colleges putting so much effort into diversification in recent years, few students fit the cookie-cutter images that proliferate in college view books.

Like with most things in life, college is what you make of it. If you are determined to study hard and find your social niche, you will probably be happy no matter what school you attend. However, that does not mean you can just throw darts at a map listing all colleges coast to coast. But it is always fun to put a pin on our office wall map when a student matriculates to a college he or she never knew existed until they went through the process I describe below. With hundreds of colleges to choose from, there will be some that fit better than others. But I have found that many students start the process without paying much attention to the purpose of going to college in the first place.

Fortunately, that can be easily rectified with some self-assessment by the student. In other words, you start the process with a careful look at yourself, not with a list of colleges. It is your own honest assessment of your academic profile, interests, learning style, and natural strengths that is central to finding a good fit college.

Most students start their lists, not only by listing well-known schools but the most competitive first. It is a faulty strategy. Before you start poring over view books and catalogs from colleges, you want to examine yourself as a person and as a student. Such an appraisal will yield data about yourself that will allow you to move forward with confidence.

So, once that is all done you can consider other things, like location, total enrollment, male to female ratio, and athletics. Do you want a college within easy driving distance to home or across the country? Many students feel both callings at one time and another. Going to a college in the same state can still provide the independence and freedom students crave if they don’t commute. If you do not plan to be going home often, however, beware of the suitcase school, where the majority of students are locals who split the campus on the weekends.

The current health care concerns based on a “novel” strain of the common Coronavirus called Covid 19 has many people concerned about how far away from home to go college. However, if you are willing to go over 300 miles from home, your pool of prospective schools will grow significantly, not to mention chances of admission may be enhanced as well. That is, if you show some genuine measure of demonstrated interest.

By the way, do NOT dismiss a college without doing your AAA due diligence simply because it has fewer students than your high school. In college, you will likely have peers from all over the country and many countries, unlike your little community of students whom you have known most of your life. It is a big world and your journey has just begun. No better place to do it than within a community where you can learn from both professors as well as fellow undergrads that come from different parts of the globe. Each of you can share ideas and experiences that will be mutually beneficial.

What is College For? 0

As we enter the second semester of the academic year, millions of high school students are anxiously awaiting college acceptance letters. Some have heard already from those colleges. The students who applied in a college’s ED, EA or rolling admissions program. But the most competitive colleges will not make their final decisions until late March for the RA pool of applications.

As we enter the second semester of the academic year, millions of high school students are anxiously awaiting college acceptance letters. Some have heard already from those colleges. The students who applied in a college’s ED, EA or rolling admissions program. But the most competitive colleges will not make their final decisions until late March for the RA pool of applications.

Other than those students who were accepted in December in an ED program, all other students will have until May 1 to make their final decisions. Before that deadline it is the colleges that will be nervous. That is, who will say Yes, I am accepting your acceptance back to them! In the college ratings game made popular by US News & Reports, the higher the yield the higher the ranking.

Yes, it is an exciting time. But let’s step back a minute and consider this. What is college for anyway? Is it REALLY worth the expense? Colleges will tell you it is an investment. But in financial jargon an investment is made in anticipation of an outcome greater than the time or money put into it. Is that what the outcome is in the majority of cases?

In May of 2011, the Pew Research Center released surveys that indicate that 57% of Americans feel that universities in the US fail to provide good value for the money spent. College has always been expensive but in the last 21 years I have seen an escalation of costs that are way out of proportion with income, with one significant exception. Parents view college price tags with a wary eye, as they should. According to the survey only 35% of the American adult public said colleges were doing a good job in terms of providing value to students; 42% said only fair and 15% said poor. In the same survey, however, 84% of recent college graduates said college had been a good investment; only 7% said it had not been.

Why the disparity in belief? Is that because young people don’t want to admit the four years plus they spent in college was money (more often a parent’s money) not well spent? What I sense some of them saying is that the benefits they received are intangible, immeasurable and not connected to what a particular degree got them.

Hopefully, as teenagers mature through their twenties they develop a fair amount of critical thinking and social networking skills. They will benefit greatly from learning as much, if not more, outside the classroom as in it. That is why I put a great deal of emphasis on understanding the nature and depth of academic and career advising at each college they are considering. The student who is pro-active in pursuing internships as an undergraduate often has an advantage amongst his peers following graduation.

Call us at Programs for Education for a complimentary get acquainted conversation. Learn how you and your children can get the best return on investment from their college experience.

He Got into Harvard? 0

I want to tell you a story about a current undergrad at Harvard College. He was not a top scholar, or an outstanding athlete in high school. How did he become one of the selected 5%?

I want to tell you a story about a current undergrad at Harvard College. He was not a top scholar, or an outstanding athlete in high school. How did he become one of the selected 5%?

At a competitive high school he was a good student, but not a stellar one. His SATs were lower than Harvard’s 1580 average and his transcript was replete with an equal amount of Bs and As. His transcript, however, showed he took the most challenging AP courses offered by his high school. He did not have a strong extracurricular resume nor was he a legacy applicant. The highest position he held was that of secretary at his school’s public service organization. Just a normal white Anglo-Saxon Protestant, don’t you think?

He was not optimistic about his chances of admission to such a competitive college. He did realize, however, that his chances would be enhanced if he worked really hard on his essays and got excellent teacher evaluations. A standout quality that he did have was that he always worked to the best of his ability. He said, I also spent a lot of time on my essay and must have written and rewritten it a dozen or more times.

When he received his acceptance letter from Harvard his friends were amazed! He was amazed! How did he do it? These are his words: It was pretty obvious that it was not my grades, scores, or activities that got me in. I think I owe it mostly to my essays and teacher evaluations.

Seniors know why we emphasize the importance of getting started on the personal statement early. Plus, it is important to follow a particular method for handling evaluations from teachers. Please remember this if you are not yet a senior.

In addition, after one year at Harvard, his grades are better than those of his fellow students, who had stronger grades in high school. The Admissions team at Harvard obviously recognized the quality of his work ethic, and strong desire to do the best he could, always.

If the reader is a high school student with aspirations of getting into one of the most competitive colleges, take note. You cannot rest on your straight-A transcript and 1580 SATs or 35 ACTs and consider it a done deal. At the most competitive colleges, they are not only looking for diversity in the student body and a decent academic record. They are also looking for the strength of character, work ethic, and intellectual curiosity, qualities that no doubt were brought out by teachers in this student’s recommendations.

Don’t Wait…It May Be Too Late! 0

Even for parents who say Money is no object, my child has worked hard and we will do whatever it takes to enable her to go to her top choice college if she is accepted a dry run exercise is always a smart idea. The parent cry for help below is not unusual. However, it can be avoided when someone who is familiar with the variable college financial aid practices calculates an accurate snapshot of a familys future Expected Family Contribution (EFC).

The earlier the better.

Please read this exchange carefully between a disappointed parent and a US News expert: and yes, this is an actual question.

Question:

My son has recently been accepted to his first choice college, Lehigh University. They have offered him loans and grants of approximately $32,000. The COA is $69,750 a year. My wife and I do not have available funds to make up the difference. What steps can you suggest to give my son the opportunity to attend this school? In high school he has maintained a high academic level, ranking 27/499.

Thank you for any suggestions that you can offer.

Answer:

I hope you have been successful in exploring your financing options. If you haven’t already considered it, a private (non-federal) student loan is another option. Many lenders offer non-federal student loans, in which the parent acts as the co-signer. Look for features such as a co-signer release once the student establishes a good repayment record, or reduced interest rates for automatic payments from a bank account. Ask Lehigh if they have any recommendations.

Best wishes to you.

Verna Hazen, U.S. News Expert

How much is free advice worth? In this case not much. Too little, too late is my first thought; what is yours? Why didn’t he find out that this would be his probable outcome earlier? Could he have? Yes. And could he then have been better prepared? Yes!

In the past, I have discussed the different methods colleges use to award aid. One of the most important facts I stress is that students are not treated equally even if the parent’s income and assets are identical. This is called financial aid leveraging. The free money (grants and scholarships) goes to the student they want most. You MUST know where your college bound child fits in the applicant pool of each college.

When we develop a list of colleges  for a student based on academic and personal criteria we give the parent a preview of probable aid packages from those schools. We often provide this information one, two or even three years before the application is sent. After your child is accepted to his or her first choice college is not the time to find out what the financial expectations will be.

for a student based on academic and personal criteria we give the parent a preview of probable aid packages from those schools. We often provide this information one, two or even three years before the application is sent. After your child is accepted to his or her first choice college is not the time to find out what the financial expectations will be.

Every year we hear of students who are accepted to their top choice colleges but cannot attend because of the cost. Colleges often provide false hopes for prospective applicants because they encourage almost every student to apply, while implying that financial aid will be there for them. (The more that apply…the more they can reject thus appearing more competitive in the now infamous rankings game.)

If you would like a free copy of the 8 Questions to Ask Every FAO and/or money– saving dry run exercise call (978) 820-1295 or e-mail help@smartcollegeplanning.org today.

Key Steps to Success 0

A college education has long been viewed as a ticket to a better quality of life. Though it is truly a milestone decision in a young person’s life it does not necessarily mean that a particular college decision will have the highest rate of return in achieving life goals. Unfortunately, some students do not think clearly about this decision, buying the brand name college and taking on large amounts of debt.

A college education has long been viewed as a ticket to a better quality of life. Though it is truly a milestone decision in a young person’s life it does not necessarily mean that a particular college decision will have the highest rate of return in achieving life goals. Unfortunately, some students do not think clearly about this decision, buying the brand name college and taking on large amounts of debt.

For students who don’t want to have daunting repayment obligations, without a solid income opportunity consider this:

- Know the average amount of debt that students carry at each of your potential colleges. Check out college-insight.org for such information.

- Complete a money-saving Dry Run before you even have a final list of colleges in mind.

- Discuss with counselors and advisors what majors to consider and understand how your natural strengths and innate characteristics fit related careers.

- Earn and save money during college. Many bright students are earning over $1000/month part-time while in college without sacrificing their academic responsibilities. Call Eric and he will show you how they are doing it.

“Excessive student debt, often made without an explicit decision on its impact on future life choices, not only restricts traditional career choices but the basic ability of young people to take risks requiring them to defer their dreams,” says Robert Shireman, executive director for the nonprofit Project on Student Debt.

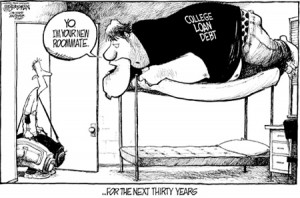

According to the Project on Student Debt, the average 2010 graduate carried $25,250 in loans. (Not to mention what the parents have borrowed.) The big galoot above says to the young graduate, “Yo! I am your new roommate…for the next thirty years.”

Astrid Neilson, a 23-year-old who graduated from the University of Virginia, assumed a huge financial burden to attend a public university as an out-of-state student. Her life is definitely impacted by the $90,000 college debt from the college. (Some were signature loans from a relative.) I really want to go to law school, but can’t unless I get a scholarship. Possible, but not likely.

Neilson did not consider future income before assuming her loans, although she anticipated always working in the nonprofit or public sector. Her choices confirm a recent survey by student-loan provider Sallie Mae that post-graduate income was not a factor for an incredible 70 % of students and parents in determining how much to borrow to finance a college degree. (Can you say Dry Run?)

So after the glossy college brochures arrive in the mail and the visits to leafy college campuses are over, students need to ask themselves: Can I afford this school without excessive borrowing? If money saved falls short, consider living at home for two years, get the necessary pre-requisites out of the way at a community college and transfer to your state or private university. Be smart now and financially independent later.

So after the glossy college brochures arrive in the mail and the visits to leafy college campuses are over, students need to ask themselves: Can I afford this school without excessive borrowing? If money saved falls short, consider living at home for two years, get the necessary pre-requisites out of the way at a community college and transfer to your state or private university. Be smart now and financially independent later.

Do not like that option? Then you should read The Millionaire Next Door.

Real World Preparation 0

Anyone who has ever been on a job interview will tell you, one of the first questions an interviewer will ask is; What kind of experience have you had that has prepared you for the position?

Anyone who has ever been on a job interview will tell you, one of the first questions an interviewer will ask is; What kind of experience have you had that has prepared you for the position?

If you are a recent college graduate and aspire to be employed (for example) as a financial analyst for a growing international company like this one, will you be able to say, Yes, thank you for asking. The two summers, while in college, working for Bain & Company in Boston inspired my decision to work for a company that has strong growth potential not only in the North American market but internationally as well.

Having already done research into the company to which you seek employment, you go on to say, I earned my BA in International Business with an emphasis on economic policy. I am also fluent in both German and Mandarin Chinese, countries in which you do business. The work I did in a collaborative team environment was to analyze the financial reports of companies to determine the areas of strength and weaknesses. We then would make proposals to make the necessary changes to replace the weaknesses with vital improvements for the short and long term.

Or will you be saying to a future employer, (because you did not take advantage of any substantive internships during college). Well, I managed the Trading Post Snack Bar at Camp Tip-A-Canoe in Vermont for two summers. At the end of the summer I showed a profit of at least $194.25 from the sale of all the cookies and candy sold to the campers.

during college). Well, I managed the Trading Post Snack Bar at Camp Tip-A-Canoe in Vermont for two summers. At the end of the summer I showed a profit of at least $194.25 from the sale of all the cookies and candy sold to the campers.

Listen up! It is not too late. There is good news for the current undergraduate here. Internships provide short-term practical experience for students and recent graduates. They may be located anywhere in the world. Check with you college career services office. In fact, a college student should know what that office does starting in the freshman year. Though many internships will be done in the summer following the junior year, the ambitious student will research and apply for one before the end of the sophomore year.

Take a look at what one enterprising student did. She saw a need and filled it! She is now known as the Intern Queen. Learn from her. By the way, you can probably guess what her personality archetype is, can’t you?

Take a look at what one enterprising student did. She saw a need and filled it! She is now known as the Intern Queen. Learn from her. By the way, you can probably guess what her personality archetype is, can’t you?

According to a recent survey by the National Association of Colleges and Employers, employers reported that, on average, more that 3 out of 5 hires had internship experience. Many employers hire directly from their internship programs.

Career counselors, books, and other resources can be helpful in the application and interview process. In fact, if you are an undergraduate or even out of college and still not sure the direction you wish to take, call us at (978) 820-1295. Let’s discuss the options that will save you time and aggravation.

Perfect SAT Scores Can Be a Detriment 0

Students are surprised when I say that a perfect 1600 SAT can sometimes be viewed as ho-hum boring. A score between 1450 and 1550 is a good target for the Ancient 8 and their ilk. They show strong reasoning skills but not nerd-like characteristics. Yes, I know, that could be an incorrect assumption, but the most competitive colleges are looking for students that have something to offer a class other than an ability to ace standardized tests. Strong SAT and ACT scores are expected from every applicant. “What else ya’ got?”

Here are the top 10 things admission committees want to see in an applicant. Number five on that list is Well Written Essays also called the “Personal Statement”. Of course, a strong GPA, challenging courses, one or two extracurricular activities in which you have demonstrated serious interest and/or leadership, honors, and teacher recommendation letters are very important factors. But only the latter and the essays say (or should say) something about the student’s personality.

The college essay is the only time the admissions folks get to hear from the student directly in his or her own voice. For most of us, writing is a chore and one of those things that we put off. Particularly in this day and age of twitter, text messaging, 30 second sound bites, and other mindless distractions. We look at the task of sitting down and thoughtfully putting ideas on paper as agony and time that could be spent on more important things like Facebook.

I know, because I have been there. It is like a giant Black Hole from which there is no escape. But I am also here to tell you that once you gather the strength, clear your head and quiet your mind you will be very pleased with yourself once the job is done.

So, if you are faced with that task and have not yet started, yesterday would be a good time to start. Follow the tips at the links above and set aside the same time each day to write. Remember, even the most famous authors had to write and rewrite several times before they were finished. Even after they thought their job was done, they needed an editor to read the draft and make suggestions and correct grammatical errors.

In other words, you will need time to do it right. Call us if you want to brainstorm some topic ideas or other help. We still have time to help before a black hole sucks us back in.

How They Look at You 0

What does need blind mean? and If I say I will not be applying for financial aid help me get accepted? are questions often asked. To the first question, a college would say it means We do not consider the financial need of an applicant when considering his or her qualifications for admittance. In fact, most all most competitive colleges describe their admissions policies as holistic. They look at the grades, test scores, essays, recommendations, activities but not the financial need.

What does need blind mean? and If I say I will not be applying for financial aid help me get accepted? are questions often asked. To the first question, a college would say it means We do not consider the financial need of an applicant when considering his or her qualifications for admittance. In fact, most all most competitive colleges describe their admissions policies as holistic. They look at the grades, test scores, essays, recommendations, activities but not the financial need.

But I say buyers beware.

To the second question, the answer is no. All families should at least file the FAFSA form. See how financial aid really works here. Though you may have found out that your eligibility of “need based” aid is not possible, circumstances could change either because of younger siblings nearing college age or loss of income. At a College Board seminar I attended, one FAO at an elite private confided in me that if a family doesn’t complete at least the FAFSA prior to freshman year…the chances of receiving aid later would be “highly unlikely”. So, the student can still claim “no” in response to the application question “Will you be applying for financial aid?” But fill out the FAFSA…not the Profile.

There are distinct patterns, typically not known by applicants that differentiate some holistic colleges from others. Most colleges focus entirely on academic qualifications first, and then consider other factors. But some colleges focus first on issues of fit between a college’s needs and an applicant’s needs.

Every college has a unique way of looking at a student. Most common among liberal arts colleges and some of the most competitive private universities, results in a focus on non-academic qualities of applicants, and tends to favor those who are members of minority groups underrepresented on campus and those who can afford to pay the full cost of attendance or COA.

most competitive private universities, results in a focus on non-academic qualities of applicants, and tends to favor those who are members of minority groups underrepresented on campus and those who can afford to pay the full cost of attendance or COA.

Rachel B. Rubin, a doctoral student in education at Harvard University did extensive research of about 75 elite colleges and universities. Her findings are summarized in Inside Higher Education.

Her research concentrated on the most competitive colleges that admit small percentages of their applicants and that generally say the vast majority of applicants are capable of succeeding academically.

I smile when I recall the picture drawn by the Dean of Admissions and Financial aid of Harvard, Bill Fitzsimmons at a College Board admissions workshop I attended. He said with over 32,000 applications every year (most very qualified applicants), it was a tough task. But once they winnowed the pile down to the last 6500 applications, he said this: We could just as well have thrown all 6500 files out the window on to Harvard Yard and admit the first 1800 we picked up. That would give us a perfectly diversified and talented freshman class. At least now it is decidedly more diverse than it was in the late 1880’s.

Speaking of Mr. Fitzsimmons, here are five questions that he responded to in an interview in 2009. The answers are an accurate depiction of Harvard’s policy and philosophy today.

Speaking of Mr. Fitzsimmons, here are five questions that he responded to in an interview in 2009. The answers are an accurate depiction of Harvard’s policy and philosophy today.

“Houston…We Have A Problem.” 0

That cryptic phrase was the actual message sent by Astronaut, Jack Swigert on April 13, 1970, to NASA Mission Control in Houston, Texas. As you will see here, it was definitely a problem. The rocket was over 200,000 miles from earth and heading toward the moon when an huge explosion occurred on board. The process by which the rocket was turned around using brilliant engineering tactical skills resulting in a successful return back to planet Earth was miraculous.

That cryptic phrase was the actual message sent by Astronaut, Jack Swigert on April 13, 1970, to NASA Mission Control in Houston, Texas. As you will see here, it was definitely a problem. The rocket was over 200,000 miles from earth and heading toward the moon when an huge explosion occurred on board. The process by which the rocket was turned around using brilliant engineering tactical skills resulting in a successful return back to planet Earth was miraculous.

The question is: Does America have the brainpower today to meet such challenges?

Now that I have your attention, let us consider the problem. The immediate problem we have has to do with the lowering of academic standards in our schools (and colleges) over the last 40 years. What kind of preparation do high school students get for college or for life in general, for that matter?

More and more American colleges have incoming freshmen that are flat out not prepared for college-level work. Even professor’s at the most competitive Ivy League schools see the diminishing writing, reading, and critical thinking skills their students have. Why is that?

For an in-depth answer to that question, you can read the insightful, exhaustive, and extensive research by Charlotte Iserbyt. Her tome, The Deliberate Dumbing Down of America is where to start.

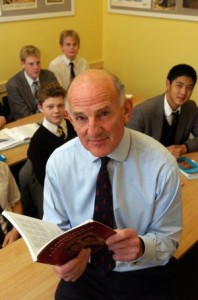

There is a myriad of good solutions to the problem. But like most things, it will need a consensus that there is a problem and an interest in the solutions. A teacher’s ability to teach is obviously important. But teaching a classroom of diverse personalities is not easy. It takes a special person who has the passion and ability to teach and inspire effectively. As I talk with high school students, I learn that their interest in various subjects often depends upon the teacher’s ability to engage and motivate them. It may not even be a subject they had an interest in before taking the class. Are you a student? Is that true?

Another challenge that principals and superintendents have is that school systems are required to meet the state and federal rules and regulations of the Departments of Education. Ms. Iserbyt does an excellent job of pointing out the problems there. Do you think that the government may have overreached and put both the teachers and students at an extreme disadvantage?

Parents should learn if the curriculum being taught is what the student needs to learn. Is it time to ABOLISH the Federal Department of Education and return education planning to the states, and more importantly the school districts? Admittedly, it will be extremely tough because most school administrators and parents have gone through the indoctrination that needs to be changed. But the interview here is where to not only see the problem but how to solve it.

In the final analysis, isn’t learning a lifelong activity? As Saint Augustine once wrote, “The world is a book, and those who do not travel, read only one page. Think about how you can leave the world better than you found it when you arrived. (Email or call for the password.)

The Changing Landscape 0

The relationship between the financial aid and admissions offices has changed over the years. Only a few colleges are still NOT need sensitive and are genuinely need blind when making their admissions decisions.

The relationship between the financial aid and admissions offices has changed over the years. Only a few colleges are still NOT need sensitive and are genuinely need blind when making their admissions decisions.

Unfortunately for the vast majority of college bound high school students, those are private schools that are extremely competitive such as Harvard, Yale and Princeton. There are about 50 colleges that still have enough cash in their budgets to fill a student’s need 100%.

Of course, the definition of need is the individual school’s (not your) interpretation of need. That is why we recommend every family complete a money-saving Dry Run years before a student even applies to a college. It is not necessary to have a final, or even preliminary list to do this exercise.

One of the first questions families used to ask when looking at a college was, “What are our chances for acceptance? (That was always an interesting way to ask it because one would think that the parent was also applying.) With the ever increasing cost of colleges that use government loans and grants to fill their aid packages, more parents are concerned about the cost and the first questions include Can I afford it?”

While admissions officers are well versed in SAT-score and GPA requirements for their institutions, it is now crucial that they know how to answer questions about eligibility for financial aid and merit scholarships. Although many admissions deans say they have always worked in close collaboration with their financial-aid offices, such efforts are becoming more critical as colleges tweak their aid policies and packaging to attract accepted students.

Various surveys and my conversations with admissions officers reveal that monetary issues weigh heavily on their minds. That concern is not shared with prospective students during the college tour. When asked which activities were most time-consuming, admissions officers ranked “communicating with other campus offices,” particularly the financial-aid office, the highest, with 70 percent reporting that they spend a “high” or “very high” amount of time on that activity. More than a dozen admissions deans interviewed by The Chronicle of Higher Education affirmed that statistic, saying they were in daily contact with their financial-aid colleagues.

Various surveys and my conversations with admissions officers reveal that monetary issues weigh heavily on their minds. That concern is not shared with prospective students during the college tour. When asked which activities were most time-consuming, admissions officers ranked “communicating with other campus offices,” particularly the financial-aid office, the highest, with 70 percent reporting that they spend a “high” or “very high” amount of time on that activity. More than a dozen admissions deans interviewed by The Chronicle of Higher Education affirmed that statistic, saying they were in daily contact with their financial-aid colleagues.

To ensure that both admissions staffers and financial-aid professionals have the same understanding of their college’s enrollment goals, many institutions have enlisted enrollment managers to oversee both offices and act as a liaison between the two. At smaller colleges, where adding more staff members might not be feasible, it has become more common for the role of admissions dean and financial-aid director

As we enter the second half of the school year and high school sophomores, juniors and some seniors schedule April visits, find out a prospective colleges financial aid methodologies. In fact, ask us for the 7 Questions to ask Financial Aid Administrators. This will smooth the way to that conversation. Having a congenial Q & A with the FAO now, could pay off in the end. Remember, most financial aid officers have your best interests in mind, but they are also subject to the school’s policies. We can help you learn what they are beforehand. Call us today.