Step One in Post Secondary School Planning 0

Contrary to what you may have been told, the purpose of college is not necessarily “to get a good job”. Though that is the most common answer I get from a student when I ask this question, it is not often the outcome. But the odds can be increased if certain steps are taken before the student enrolls in college, trade school, or neither one.

Contrary to what you may have been told, the purpose of college is not necessarily “to get a good job”. Though that is the most common answer I get from a student when I ask this question, it is not often the outcome. But the odds can be increased if certain steps are taken before the student enrolls in college, trade school, or neither one.

Through a series of conversations and four (4) insightful self-assessments, we show students and parents how to identify what a “good job” is for them. Clearly, what a “good job” is for one person is an awful job for another. If college is indeed the next step after high school, then how does one’s future academic concentration (or major) prepare one for that good job? In fact, during the global economic shutdown that we all experienced when your high school teenager just started high school, there were no doubt challenges. due to the latest virus concern, this step is the best time since yesterday has passed, to focus on this step for high school and college students if they have not yet done so.

History tells us that the average student changes majors more than twice during the college years. How does one narrow the myriad of choices down to one…or two?

Many colleges in order to compete for students are becoming increasingly aware of the importance of providing the kind of academic and career advising that is more matched to the individual student. They realize that with the cost of college not getting any cheaper if they are to stay in business the curriculum needs to be more relevant than ever before.

Most parents plan for their children to follow a four-year course of study. Changing majors and spending more time in school will quickly drain college savings and contribute to the debt. That is why we recommend all students take some time to do some serious self-reflection while they are still in high school.

Most parents plan for their children to follow a four-year course of study. Changing majors and spending more time in school will quickly drain college savings and contribute to the debt. That is why we recommend all students take some time to do some serious self-reflection while they are still in high school.

“Yea, right!” I hear you say. “To get my teenager to sit down do some “self-reflection” is like telling our Shih Tzu puppy to sit still when someone comes to the door.”

Yes, it is a challenge; but one worth taking on. For more information on how to identify not only appropriate colleges, academic concentrations but career options as well, give us a call or email. (978) 820-1295 …help@SmartCollegePlanning.org In the meantime, pay attention to what Albert Einstein said about education above! That is the one of the MOST important skills, particurlarly critical thinking we should be conscious of, regardless of our age.

Getting Into the Mind of the Applicant 0

GETTING INTO THE MIND OF AN APPLICANT

Because I have a passion to learn about all forms of alternative healing and disease prevention modalities, I once took on the role in 1989 of human pincushion for a student at the New England School of Acupuncture. Come to find out her Dad, Jack Maguire and former Boston College professor, was the founder of one of the first firms in the US to successfully build a client base of colleges and show them how to attract teenagers to their colleges. Not only get them to apply, but to fill seats with the highest revenue/seat as possible. I learned a lot from him.

Because I have a passion to learn about all forms of alternative healing and disease prevention modalities, I once took on the role in 1989 of human pincushion for a student at the New England School of Acupuncture. Come to find out her Dad, Jack Maguire and former Boston College professor, was the founder of one of the first firms in the US to successfully build a client base of colleges and show them how to attract teenagers to their colleges. Not only get them to apply, but to fill seats with the highest revenue/seat as possible. I learned a lot from him.

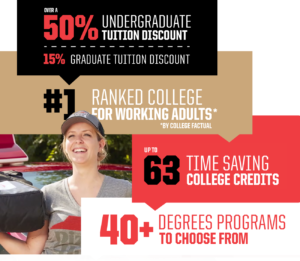

It was his firms highly successful and respected reputation, that led to the emergence of the “Enrollment Manager” position in colleges. Many colleges have long devised enrollment strategies to ensure their survival and vie with competitors; now their tactics are much more sophisticated. No enrollment-management tactic is more controversial than the tuition discount. These days, many colleges see the strategic use of so-called merit aid as an essential recruitment tool, a means of  attracting students who can pay all or most of the cost. Nevertheless, the presidents of some small colleges have described the widespread practice as unsustainable and unethical, especially in an era when so many families have ever-increasing financial need.

attracting students who can pay all or most of the cost. Nevertheless, the presidents of some small colleges have described the widespread practice as unsustainable and unethical, especially in an era when so many families have ever-increasing financial need.

But when we opened our college consulting doors in 1992 the Internet was just a weird technology and not understood by most. Even Harvard drop-out, Bill Gates said, it’s just a passing fade a few years before but certainly not today. Teenagers today know more about computers and the myriad of social media sites etc. etc. than I ever will. 🙂 The ways that prospective college students do their research just on their phones is presenting a real challenge to colleges.

That complicates life for the VP of Enrollment Management, whose ability to meet numerous institutional goals, academic profile, and tuition revenue depends on forecasts of how many students will eventually matriculate. The less colleges know about applicants, the hazier their crystal balls become. Who’s serious? Who applied only as a worst-case backup option? Such questions echo across a competitive marketplace as many administrators watch the steady decline of their yield, the percentage of accepted students who enroll.

That complicates life for the VP of Enrollment Management, whose ability to meet numerous institutional goals, academic profile, and tuition revenue depends on forecasts of how many students will eventually matriculate. The less colleges know about applicants, the hazier their crystal balls become. Who’s serious? Who applied only as a worst-case backup option? Such questions echo across a competitive marketplace as many administrators watch the steady decline of their yield, the percentage of accepted students who enroll.

Colleges will continue to waste money by bombarding prospects flyers and brochures, along with the annoying auto-responders, when they start surfing college websites. They use social media a lot too. “It’s so important to my generation,” one student told me, “to see what’s really going on.” But, when I work with students, I will work to bring them back to center and establish solid pragmatic parameters around the college search process. This includes understanding the financial responsibility of their eventual decision by May 1 of the senior year.

Pursuit of the Truth Should be an Ongoing Quest 0

Many of us remember the inspiring words delivered by our 35th President, “Ask not what your country can do for you, ask what you can do for your country.” The Peace Corps was one of JFK’s dreams that is still carried on by not only college graduates but altruistic older adults as well.

Many of us remember the inspiring words delivered by our 35th President, “Ask not what your country can do for you, ask what you can do for your country.” The Peace Corps was one of JFK’s dreams that is still carried on by not only college graduates but altruistic older adults as well.

JFK woke up many independent thinkers of his generation. But his tragically short administration ended on Friday, November 22, 1963, AP US History books barely talk about it other than to say he was the President prior to LBJ who passed the Civil Rights Act of 1964. That Act was the culmination of what JFK started albeit slowly because of Democrat resistance in the south during his Presidency.

Subsequent to his death, many thought (as I did) that JFK had the intent to return our current banking system to the control of the US government, not a central bank controlled by international bankers. This would require changing the way the private Federal Reserve did business or eliminating it altogether, as Abraham Lincoln tried to do before he was assassinated. Unfortunately, that may not be accurate, as this historian points out.

In any case, following his tragic death, many changes took place. One may come as a shock to you. It was the scheme by the Rockefeller and Carnegie Foundations to promote and fund the women’s ‘liberation’ movement. As a strong supporter of women, I thought that was a good thing. But there were ulterior motives behind what appeared to be a noble effort by the financial backers of the women’s lib movement.

The private banks that own the Federal and State tax-exempt Federal Reserve (watch that superb documentary) needed more citizens to pay taxes. More money they printed (out of thin air) and loaned with interest to Congress needed to be paid back. In the 1950’s it was rare that a mother would have a full-time job outside the home. One parent’s income would cover most family needs. In time, because of increased government borrowing and the resulting devaluation of the dollar, it became necessary for both parents to be working to pay the bills for basic goods and services. It was a strategy that has had a subtle negative short and long-term effect on many families. As a Rockefeller family member revealed to the late highly respected movie producer Aaron Russo, it was designed to do just that.

The private banks that own the Federal and State tax-exempt Federal Reserve (watch that superb documentary) needed more citizens to pay taxes. More money they printed (out of thin air) and loaned with interest to Congress needed to be paid back. In the 1950’s it was rare that a mother would have a full-time job outside the home. One parent’s income would cover most family needs. In time, because of increased government borrowing and the resulting devaluation of the dollar, it became necessary for both parents to be working to pay the bills for basic goods and services. It was a strategy that has had a subtle negative short and long-term effect on many families. As a Rockefeller family member revealed to the late highly respected movie producer Aaron Russo, it was designed to do just that.

Most college students don’t know that the Internal Revenue Service is a de facto government agency. It is simply  the collection agency for the private international bankers that own the Fed. Not a dime of the Federal income tax paid to the IRS goes to the US government. It all goes to the interest on the debt incurred by our Congress that borrowed the fiat currency to pay for various programs; perpetual wars and covert intelligence activities around the globe.

the collection agency for the private international bankers that own the Fed. Not a dime of the Federal income tax paid to the IRS goes to the US government. It all goes to the interest on the debt incurred by our Congress that borrowed the fiat currency to pay for various programs; perpetual wars and covert intelligence activities around the globe.

In July 1944 the world’s leaders met at the Mount Washington Hotel in Bretton Woods, NH to set the US dollar as the world’s reserve currency backed by gold and silver. In 1971 President Nixon, without consulting with other member nations, severed (“temporarily”) that agreement to link the value of the dollar to gold. The ‘golden age’ and credibility of the US dollar was over. This action was not a temporary measure; the global markets were flooded with fiat money which has increased over the years, leading to massive borrowing to fund the abovementioned questionable activities. For example, just the fraudulent war in Afghanistan costs the US 300 million dollars a day! And do not ignore the even more astronomical other costs of war.

Since the declaration of a worldwide Pandemic at the beginning of 2020 many are questioning why the entire global economic system was shut down allowing only “essential” businesses to remain open with restrictions. There have been many pandemics, over the years (remember this one?). As long as you are reading about the importance of education, it is important to learn about your natural immune system and the part it plays in protecting you from an illness; something vaccines will NOT DO, because they are not designed for that purpose in the first place. In fact, there is evidence that what is being called vaccines are NOT vaccines at all. But they are actually experimental gene therapy injections and do NOT meet the CDC-stated characteristics of vaccines. (By the way, none of the thousands of victims from vaccinations given to them for Swine Flu in 1976 reported on the 60 Minutes TV show above, like Judi Roberts, who died in 2010, ever got any financial compensation from the pharmaceutical cartel.)

Since the declaration of a worldwide Pandemic at the beginning of 2020 many are questioning why the entire global economic system was shut down allowing only “essential” businesses to remain open with restrictions. There have been many pandemics, over the years (remember this one?). As long as you are reading about the importance of education, it is important to learn about your natural immune system and the part it plays in protecting you from an illness; something vaccines will NOT DO, because they are not designed for that purpose in the first place. In fact, there is evidence that what is being called vaccines are NOT vaccines at all. But they are actually experimental gene therapy injections and do NOT meet the CDC-stated characteristics of vaccines. (By the way, none of the thousands of victims from vaccinations given to them for Swine Flu in 1976 reported on the 60 Minutes TV show above, like Judi Roberts, who died in 2010, ever got any financial compensation from the pharmaceutical cartel.)

In addition, it is tragic that so-called institutions of “higher” education are still believing all the hype (aka lies and disinformation) and continue to push the allopathic medical/pharmeacuitical narrative. Honest scientific research and little critical thinking still exist there.

Evidence of that is succinctly provided in two recent 30 minute video talks by Dr. David Martin, Ph.D. Watch them both in there entirity before you believe everything on the CFR controlled network news.

There is now talk of a “Bretton Woods II” designed to gradually, but significantly change how business is transacted locally and globally by bringing about what the World Economic Forum officials are calling a “Global Monetary Reset”. Because they know most citizens of the world have limited attention spans they are coming right out with what they plan to do “in plain sight”! The plan is to replace paper money (currently printed out of thin air) with digitized money, also out of thin air, with no gold or silver backing it as it was originally set up in 1944 at the Bretton Woods Conference in N.H.. Even PBS’s Elmo on Sesame Street helps the World Economic Forum prepare children for the great “Global Reset”.

Matthew Blake has an impressive resume and a very slick three-minute presentation using jargon that may “cloud men’s minds” to what Klaus Schwab’s agenda for the “Global Reset” really is. Listen VERY carefully as you: Watch this. He finishes his smooth, albeit abstruse, presentation by ending his PR promo with “At the end of the day…”. A common phrase to soften what basically is a crime against humanity of massive significance to every human on the planet! For a FULL understanding of the true purpose behind the latest pandemic, one needs to sharpen one’s critical thinking skills and read this detailed analysis in its entirety, something, regretfully, most citizens will not do…will you? For a fact-filled video with an international attorney, watch this.

Matthew Blake has an impressive resume and a very slick three-minute presentation using jargon that may “cloud men’s minds” to what Klaus Schwab’s agenda for the “Global Reset” really is. Listen VERY carefully as you: Watch this. He finishes his smooth, albeit abstruse, presentation by ending his PR promo with “At the end of the day…”. A common phrase to soften what basically is a crime against humanity of massive significance to every human on the planet! For a FULL understanding of the true purpose behind the latest pandemic, one needs to sharpen one’s critical thinking skills and read this detailed analysis in its entirety, something, regretfully, most citizens will not do…will you? For a fact-filled video with an international attorney, watch this.

If you have read this far, you may be asking “what can we do?” You have now learned some of the reasons behind this latest virus scare. Now, more of us need to listen to legal scholars, like Peggy Hall, who is being heavily censored by the CFR-controlled media. This interview will help the reader understand what action is now been taking place in various parts of the world and what the average person can do to stop the insane criminal madness.

Yes, there is a solution! (Email or call for the password.) But it requires the opening of our hearts and minds and being aware of our own cognitive dissonance. If that common, albeit limited way of thinking is not recognized, it will be very hard, if not impossible, to “see the big picture” let alone change it for the better. Finally, before you ask for the password to my essay that lays out the solution based on accurate knowledge of history NOT taught in schools or colleges carefully listen to this.

What! Me Worry? 0

Dear Class of 2028 and beyond,

One of the most popular humor magazines during my high school years was MAD magazine. Are you familiar with it? Staring out on each issue’s cover was the silly-looking young man on the left. He was Alfred E. Neuman with his perpetual gaped-tooth grin and his now universally known exclamation, “What! Me worry?” It was a timeless teenage sentiment. Can you identify with that? If you are midway through your sophomore year, congratulations —you will soon start your junior year, one of the most significant and most challenging college-bound classes in your high school experience! Do not worry.

One of the most popular humor magazines during my high school years was MAD magazine. Are you familiar with it? Staring out on each issue’s cover was the silly-looking young man on the left. He was Alfred E. Neuman with his perpetual gaped-tooth grin and his now universally known exclamation, “What! Me worry?” It was a timeless teenage sentiment. Can you identify with that? If you are midway through your sophomore year, congratulations —you will soon start your junior year, one of the most significant and most challenging college-bound classes in your high school experience! Do not worry.

But do pay attention. You may be in the same place I was. Perhaps you are fifteen or sixteen years old with vague college aspirations? You may not have any specific reason to go to college other than it is the expected thing to do, and/or everyone else is doing it. Not everyone plans to attend college, and some of your classmates may not pursue higher education. That is, not a four-year liberal arts college. They may want to pursue technical training, education, or some certification, however.

Why is College So Expensive? 0

The cost of private four-year colleges and universities has steadily increased far beyond the means of all but a small % of American households. Here are the reasons as to why college is so expensive.

The Higher Education Act of 1965 marked the beginning with NO end!

President Johnson signed the Higher Education Act in 1965. The act aimed to strengthen the educational resources of our non-profit colleges and universities in the US and provide financial assistance to students in postsecondary and higher education. What first appeared to be a positive thing has become something entirely different.

There are four primary reasons for that. Read the linked history!

- In 1971, President Nixon broke the 1944 Bretton Woods Agreement and removed the dollar from the gold standard. The Federal Reserve was printing dollars like there was no tomorrow during what is now known as the “Guns and Butter” decade of the sixties. Nixon’s move was the catalyst for inflation as the dollar lost value.

- One year later, Nixon signed Title IX of the Civil Rights Act into law. Many of the most expensive private colleges were beginning to admit women. Title IX prohibits gender-based discrimination in any college or other education program that receives funding from the federal government, aka American taxpayer dollars.

- In the fall of 1979, President Carter raised the Department of Education (DOE) to a cabinet-level position. All colleges agreed with the principles of Title IX. However, a few questioned the long-term impact the law would have on academic freedom and the cost of college. One of those was a highly regarded regional liberal arts college in Pennsylvania…Grove City College. It did not agree to sign the Title IX agreement because it had already followed the ideals of Title IX since the co-ed colleges’ founding in 1876.

- Upon close examination, the college’s Board of Directors decided Title IX would increase families’ college costs.

Grove City College was 100% correct!

But they had to go all the way to the Supreme Court to maintain their independence. Watch the video on their website. www.GCC.edu. (Type ‘Supreme Court Case’ in the search box.) That is proof enough to show how Title IX has been the key factor in why college is so expensive today!

The entire cost of attendance (COA) for a most competitive four-year private college in 1962 averaged $2300 to $3200/year. 2025, those same colleges will cost $75,000 to $85,300/year. State universities now cost up to $39,000/year. (Out of state, $51,000.) Financial aid has not made the colleges affordable. In fact, in most cases, it has made them more expensive and put more students and their parents into debt. The formulas used to determine “need” penalize families that save for college. The Asset Protection Allowance (APA) in 1990 has been steadily reduced to Zero in 2024! Read what follows carefully.

The Higher Education Act of 1965 included Stafford loans to students at an increased annual amount over five years. However, by 1980, colleges began to increase their yearly costs as the DOE expanded the grant and loan amounts to students with need. All kinds of adjustments to benefit colleges more than students began to be seen by astute observers. None of which could be forgiven in bankruptcy.

As families became alarmed at higher costs, the paid college lobbyists went to work and influenced the lawmakers in Congress to make adjustments to “help” families afford college. The DOE made it even less affordable. In 1980, the Parent Loan to Undergraduate Students (PLUS) was introduced as a “generous” funding source for parents. Only one parent needed to sign, and no serious credit check was required. The borrowing limit was $4000/year. However, as colleges increased their costs, their lobbyists went back to work…for the colleges.

In 1993, the $4000 annual cap was removed, allowing parents to borrow up to the full cost of attendance, less any other financial aid received by the student. That soon put parents in more debt than the students with their Stafford loans.

It gets worse. Now, Congress does not even believe a family of four, for example, with the oldest parent, age 48, needs an emergency fund of about $49,000! Such budget planning was once sacrosanct and basic to sound family financial planning. It does not say much about either Congress or “non-profit tax-exempt” colleges’ understanding of basic economics. Now, three to six months of household expenses are considered an asset to pay for college. Not to mention any tax-deferred annual retirement contribution added to the 401 K or IRA that was invested just prior to and during college years. Once again, proof of the care-less attitude and/or ignorance of the DOE and Congress to American families financial planning efforts.

Plus, Congress continues to bend under the pressure of paid college lobbyists NOT to increase the financial need when a family simultaneously has more than one student in college! In other words, if the Student Aid Index (SAI), formerly the misnamed Expected Family Contribution (EFC), was $40,000 with one in college, it would be the same for each student in college, not $20,000/per student. (Fortunately, some private colleges using the Profile may use their “professional judgement”, however, to reduce the SAI per-student in college if more than one in college at the same time.)

The Department of Education’s Federal Student Aid Office changes will affect seniors, rising 11th graders, and younger. Therefore, parents should be aware of what is coming for planning purposes. If a family with more than one child is not debt free by the time the first applies to college, the family income is less than $400,000, and the family is living below its means, there will be some challenges ahead.

The good news is that practical solutions can be implemented to lessen stress and lead to positive outcomes. It is a simple three-step process.

Call Programs for Education @ (978) 820-1295 or email help@SmartCollegePlanning.org to learn about the money-saving Dry Run that very likely will save you thousands each year in college costs, not to mention time. Or email for the “Eight (8) questions you must ask the financial aid officer”.

Do You Have College Aspirations? 0

The college-bound Class of 2027 is now in their junior year. Is that you? In some ways, it is the most important year for you. It is your last reprieve before the hectic college admission schedule of senior year begins… not in September, but in June 2026. Just ask the seniors what this means and they’ll tell you! But you can avoid most of the stress and frenzy by getting organized this fall semester. You should have already set up an account at www.Commonapp.org even if you think you are only going to apply to a state university. Even if you are a freshman. Call us with any questions anytime. (978) 820-1295

The college-bound Class of 2027 is now in their junior year. Is that you? In some ways, it is the most important year for you. It is your last reprieve before the hectic college admission schedule of senior year begins… not in September, but in June 2026. Just ask the seniors what this means and they’ll tell you! But you can avoid most of the stress and frenzy by getting organized this fall semester. You should have already set up an account at www.Commonapp.org even if you think you are only going to apply to a state university. Even if you are a freshman. Call us with any questions anytime. (978) 820-1295

As a junior, you can probably see the end of your high school career is near. One of the most important factors that colleges take into account is your course selection and grades. Colleges also place more emphasis on your junior and senior grades than those from previous years. (Excuse me! That is NOT true, it depends on the college.)

Junior year is also the second-best time (sophomore is better) for most of you to be participating in meaningful extracurricular activities. However, only get involved in the activities that truly interest you. Try to make a significant contribution to something that you enjoy doing outside of the classroom. It does not have to be school-related either. When colleges look at your activities they want to see the quality of participation, not quantity. This year may also be a good time to drop some of the activities that you really don’t care for and focus on those that you enjoy.

If you’ve never had a meaningful conversation with any of your teachers, now is the time to do so. Don’t force it, but building a natural teacher-mentor relationship with your teachers is a good thing. Next year you will need to ask at least two or your junior year teachers for recommendations. Ideally, he or she will be able to not only write about your intellectual curiosity, improvement over the year, and overall classroom participation. but something specific you have done in that class. At the MOST competitive colleges, with thousands of applicants with identical academic profiles, the recommendations can be the deciding factor. After you click the link above and read my essay there, ask me for the special “icing on the cake” letter that you can send along to the teacher, with your all-important thank you letter!

Finally, you should also take this time to start collecting and organizing information from colleges. If you have started this process with us, you now have a good list of colleges based on the results of four insightful self-assessments (Personality ~ Nine Natural Intelligences ~ Learning Style ~ Skills) and your personal preferences. Plan to visit colleges during your winter and spring breaks later this year. For now, you can visit colleges on the web using the AAA method to become familiar with what they have to offer and if they have the qualifications to help you reach your goals. In your personal binders you have my essay on “How to Get the Most Out of Your College Visits” . But here is another one. Let me when and where you will be visiting, if possible. For particular colleges I may have some specific tips for you. (978) 820-1295.

How to Ensure That College is a Good Investment 0

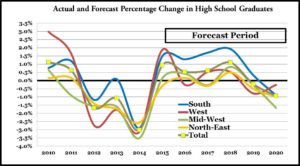

When the high school Class of 2026 becomes the college Class of 2030 as freshmen in college, the College Board continues to support the belief that earning a college degree now is more important than ever in the global economy. A typical bachelor’s degree recipient, they claim, earns 80 percent more than a high school graduate over a 40-year career, amounting to more than $500,000 over a lifetime. That financial incentive has resulted in an enrollment surge for American colleges and universities in the past decade.

When the high school Class of 2026 becomes the college Class of 2030 as freshmen in college, the College Board continues to support the belief that earning a college degree now is more important than ever in the global economy. A typical bachelor’s degree recipient, they claim, earns 80 percent more than a high school graduate over a 40-year career, amounting to more than $500,000 over a lifetime. That financial incentive has resulted in an enrollment surge for American colleges and universities in the past decade.

In addition, since 1990, supply and demand and increased Federal Aid loan and grant programs (for the poor) have allowed colleges to continue raising tuition and fees faster than inflation. (Grove City College is a prime exception.) This has stretched parents’ budgets, with incomes ranging from $100,000 to $350,000, to save even enough to cover one or two years of college costs. In past posts, I discussed why college is so expensive.

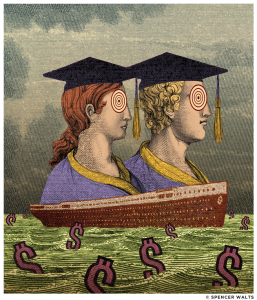

When the financial bubble burst because of lack of oversight of investment banks in 2008, average college costs in the U.S. consumed some 40 percent of median earnings in the United States, up from less than a quarter of income eight years earlier.  Now, as students and parents have fallen prey to the student loan scam, debt has surpassed more than $1 trillion, and parents are asking what they were getting in return for the high cost of a college degree. While the value of higher education in preparing for a career continues to be the big selling point in promoting college, prospective students and their parents are beginning to cast doubt on the return on investment of certain majors and particular colleges.

Now, as students and parents have fallen prey to the student loan scam, debt has surpassed more than $1 trillion, and parents are asking what they were getting in return for the high cost of a college degree. While the value of higher education in preparing for a career continues to be the big selling point in promoting college, prospective students and their parents are beginning to cast doubt on the return on investment of certain majors and particular colleges.

In response, many colleges, like Lafayette and High Point University, are focusing even more on their students’ outcomes and putting in place programs to prepare their undergraduates for the job market better. In an extensive survey of college leaders conducted by The Chronicle of Higher Education in the fall of 2014, six in 10 reported increased discussions about job preparation for their graduates in just the past three years. The survey, completed by some 800 vice presidents, deans, and directors at two-year and four-year colleges, focused on their attitudes about the value of their degrees, strategies to measure the outcomes of their graduates, and what skills higher education should provide to students.

President Obama used the annual address to announce new higher-education proposals that did not bring joy to college administrators who wanted more federal dollars for student aid. But on this night, the president was not to announce any new federal investment in higher education. Instead, he said his administration would release a new College Scorecard that parents and students can use to compare schools based on a simple criterion: where you can get the most bang for your educational buck.

Now, a government tool (and additional layers of costly, redundant bureaucracy) would turn college into a product to compare in the same way consumers size up cars or televisions in Consumer Reports. The more things that change, the more they stay the same. Everyone wants to protect what they have, mainly if what they have is a cash cow.

Working with students with college aspirations, we show them the value of following steps that will lead to the outcomes they want. One of those steps is helping them discover what they want, and another is helping them understand the financial ramifications of those decisions.

While colleges and universities attempt to redefine their approaches to measuring student outcomes after graduation, we show families how to do their due diligence in estimating the merits of colleges by asking good questions and applying good old, albeit rare, critical thinking.

While colleges and universities attempt to redefine their approaches to measuring student outcomes after graduation, we show families how to do their due diligence in estimating the merits of colleges by asking good questions and applying good old, albeit rare, critical thinking.

It all starts with a complimentary get acquainted, no obligation conversation with us at (978) 820-1295. Simple postgraduate surveys are not enough for many prospective parents and students. However, there are proven methods to prepare students for the job market and measure their success long after graduation.

Are You Ready to Apply Early Decision, or for that matter Early Action? 0

It never fails. As fall approaches each year, college-bound seniors are being asked by their peers, What schools are you applying early to? or What is your ED (early decision) school? The questions are almost presumptive in tone as if applying early is the best strategy in applying to college.

Students assume they will be applying early somewhere. Forget about the fact that they may have not even started the essays, done any substantive research into the college or have learned if it is affordable or not and how the adcoms will look at that them.

I remind them each year that if they have identified a college that it absolutely their first choice and would die if not admitted, to discuss the merits with me. There are many different types of admission policies. Here I will discuss how to approach making the Early Decision, decision. But it is also applicable for Early Action which is often a more competitive pool in which to compete.

However, since Early Decision is a binding commitment to attend if admitted, it is important to make sure that each student considers the most important question of all. That is Is applying Early Decision the right choice for you? Here’s a self-quiz to help you decide if you’re ready to apply Early Decision.

Answer Yes, No or Not Sure to the following questions:

1. Are you applying Early Decision mainly because you have decided that one particular college is your clear first choice?

2. If the college you’re considering for Early Decision suddenly became less prestigious, or its ranking dropped 50 points, would you still want to apply to this college Early Decision?

3. Would you still want to apply to Early Decision college if your chances of admission were the same as if you used to attend Regular Decision?

4. Have you visited your prospective Early Decision College at least once, including taking a formal admissions tour rather than just walking around on your own?

5. Have you visited several other colleges, including taking their formal admissions tour rather than just walking alone?

6. Have you had some form of personal contact with the admissions office at your prospective Early Decision College? Have you researched the internship requirements, if any, for your prospective major?

How to Show You Are Interested 0

When I looked at colleges, DI stood for drill instructor, not demonstrated interest. Many kids in my generation had very little interest in knowing the DI. In the myriad of acronyms and abbreviations surrounding the college process today, DI refers to the level of interest the applicant demonstrated in a particular college.

When I looked at colleges, DI stood for drill instructor, not demonstrated interest. Many kids in my generation had very little interest in knowing the DI. In the myriad of acronyms and abbreviations surrounding the college process today, DI refers to the level of interest the applicant demonstrated in a particular college.

How important is the college admissions committee (ad com) placed on demonstrated interest? The answer is not much, some, and very much. In other words, it depends on the college. Emory and American, for instance, will admit it considers the applicant’s level of interest. Others, like Stanford and MIT, may say it does not matter how much interest you show; they look at all applicants equally. But I suspect they say that to ward off students who want to game the system, as you will learn here.

Regardless of what a school may say, I recommend that all students try to show demonstrated interest and learn as much about their prospective colleges as possible. It all starts with research using the AAA method. Once that is accomplished, the student should have a good idea of the appropriateness of each college on his or her list. Is it a good fit intellectually, compatible with one’s values, and, based on the Common Data Set, is it a reach, a 50/50, a safety, or in the snowball chance in ____ category? Not to mention, are they affordable? Further inquiries must be made if such due diligence still leaves the college on the list.

Such inquiries may be described as showing demonstrated interest, and that is fine. For instance, prospective students should know the depth and nature of academic internships and career advising. Other good conversation starters are:

- Is the faculty 100% invested in the teaching of undergrads, and if teaching assistants are used, what are their responsibilities? (Universities primarily)

- What has been the four-year graduation rate over the last four years, and does it vary with major?

- Are specific programs offered in the (your intended major) department going to be expanded or cut back?

- I am a student at a high school that does not give grades. Are you familiar with the ________ Schools curriculum? How do you compare my application with someone from a more traditional high school?

- What will be the merit scholarship criteria for the _______ Scholarship next year?

Do this more to learn more about the school’s attitude toward students than with the intent of buttering up the regional admissions counselor. Colleges can spot the disingenuous inquiry. Thoughtfully think about the questions before you call (or email) them. Of course, be sure you are not asking questions already answered in the college website’s fast facts or FAQ sections.

By the way, too many students are taking their safety schools for granted. Applicants should have some good reasons why they would be okay with their safety, too. Carefully research and show interest in them as well. Such fallback colleges have been known to wait-list or reject students whom the adcom has determined would not attend if accepted. No college markets itself as the # 1 favorite safety school, so buyers beware. Even state colleges are hard-pressed to admit the students they once could because of the overflow of applicants. States are cutting back faculty, programs, and other costly expenditures that have once been taken for granted. In many cases, a top student may be able to go to a private college at much less than a state-supported public.

If you are in the Class of 2026, now is the time to review your college list. Most of you will take the SATs and the ACT this year. At the end of June 2025, you will start the college application and essay writing process; call or email us if you need help.

Good News for the Undergraduate 0

For 30 years, I have been encouraging college students to take full advantage of their college’s advising services. (Get your gift below.) This includes professor mentoring, internships, and the Career Planning Services office. One does not have to look very far to learn that many college graduates are leaving college with student loans and few job prospects, much less any related to their chosen major.

Over the last four years, we have had challenges stemming from the global pandemic that put a strain on the economic systems world wide. What was not understood is that over 98% of healthy humans are either immune or can recover with by following simple health regimes and gain an understanding of the innate power of the human immune system. Hopefully, if you a student with aspirations to become a doctor or nurse you will be required to study text books like this. Pandemics have occurred over the years; remember this one? I have been a lifelong proponent of teaching the values of Naturopathic and Allopathic methods toward achieving wellness. In the ER, for example, the latter’s procedures would be more important than the former. I encourage everyone to do their due diligence in understanding the principles and steps toward achieving and maintaining optimal health. I have been giving easy to digest (pun intended) seminars this past year teaching those steps. Thankfully, it is not rocket science. Call me at (978) 496-7462 for the books and simple methods, I recommend to students and adults to learn how to strengthen your immune system. Now, back to more good news!

It is encouraging to see more colleges proactively taking their role as advisors. For instance, look at Lafayette College’s website. They start preparing students when they are freshman. In addition it will open their books to prospective students with information about what past graduates have been able to accomplish.

It is encouraging to see more colleges proactively taking their role as advisors. For instance, look at Lafayette College’s website. They start preparing students when they are freshman. In addition it will open their books to prospective students with information about what past graduates have been able to accomplish.

If you are a recent graduate or parent considering doing something new, here are two resources I can confidently recommend. They can work with you wherever you call home. 🙂

1. Kim Meninger, MBA, a very intuitive Executive Coach and Career Strategist. Take your first step here.

2. Joanne Meehl Career Services offers terrific tips on her Blog and one-on-one counseling. She offers a plethora of resources and personal insight from her her years of experience in both counseling and networking, regardless of your age. Sign up today for her newsletter.

If you are a college student, how much research into the advising and internship options have you done? If little, familiarize yourself with the career services office, even if you are a freshman. By the way, one student who took interning VERY seriously turned her experience into a business. Meet Lauren Berger, the InternQueen.

Once you have successfully navigated the first year and know what is expected academically, it is time to get serious and consider why you are in college.

The passing of Steve Jobs reminded me of his 2005 graduation talk to Stanford graduates. It is undoubtedly one of the finest commencement speeches ever delivered in history! Here is the life-changing message. Think about what he said. For me, it was one of the most insightful and spiritually aware statements of purpose I have ever heard. Let me know what you think.

Speaking of “insightful,” if you have done your four (4) insightful self-assessments with us, do not forget they reveal within them a rich resource of career descriptions and academic concentrations that match up to your natural strengths and innate characteristics that will comprise your personality for your life on this planet we call Earth!

It will be at your fingertips for years to come. Take advantage of that. If you have not bookmarked the link, I will send you the link. In addition, if you have any questions regarding your choice of major, send me an email ~ help@SmartCollegePlanning.org

Finally, for all undergrads (or recent grads) who complete our undergraduate survey here by August 31, 2025, I will send you a book of paramount importance, whatever your major. I look forward to hearing how you are doing soon.