A History Lesson 0

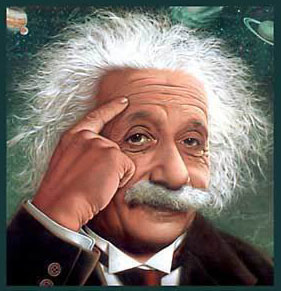

“You cannot solve a problem with the same thinking that created the problem.”

That quote has been attributed to Albert Einstein. I am unsure in what context he said that, but a lesson could be learned regarding the decades of escalation of national debt, not just individual debt. One does not have to look far to recognize there is a problem. To solve the problem, therefore, we must NOT rely on the same thinking of the people (or institutions) who created the problem.

That quote has been attributed to Albert Einstein. I am unsure in what context he said that, but a lesson could be learned regarding the decades of escalation of national debt, not just individual debt. One does not have to look far to recognize there is a problem. To solve the problem, therefore, we must NOT rely on the same thinking of the people (or institutions) who created the problem.

When the world was getting back on its feet following World War II, the US economy expanded. As in WWI, our nation was not subject to the civilian deaths and property destruction in Europe, Asia, and elsewhere. We were seen as the leaders of the Western world.

In July 1944, delegates from 44 countries met at the Mount Washington Hotel in Bretton Woods, New Hampshire, to set monetary policy for the “civilized” world. The delegates agreed upon a policy that set the US dollar (backed by gold and silver) as the standard for world currency. From that event came the International Monetary Fund (IMF), and the system of exchange rate management was established.

That system stayed in place until the country overspent during the “guns and butter” decade of the 1960s. In 1971, the decision was made to remove the dollar from the gold standard. Watch this short historical video of President Nixon’s announcement of that action. That marked a significant issuance of fiat currency (money created out of thin air) by the “Federal” Reserve *, a dollar devaluation, and ever-increasing debt. Here is a more complete explanation of its impact on the world economy to the present day. (* The “Federal” Reserve is a privately owned entity exempt from audit or any substantive US government oversight.) Below, Angela Grant, a bright 12-year-old, provides a solution for the US and Canada, with the help of her parents ‘ critical thinking skills.

It may be a fantasy, but I suggest we teach true history and basic money management in every high school. Many students who major in economics in U.S. colleges do not even understand the exponential value of money. Nor do they know as much as this bright 12-year-old has learned in Canada. I once interviewed a Harvard graduate for a position offered by the firm I worked for. He majored in Economics, and when I asked him if he could explain the Rule of 72 as it relates to money, he did not know what I was talking about!

The problem is that we are a society that does not save; we spend. Saving, not spending, grows the economy. This is not what we are taught in school. Believing that a college education is a right (or even a necessity) puts our teenagers into debt. If college is the next milestone step in a teenager’s life, he or she should understand how that financial decision will impact their future. So many college graduates have the rule of 72 working against them rather than for them. Over the last 25 years, I have watched college costs escalate higher than the inflation rate. As the federal and state governments made more grants and loans available for colleges to fill a family’s financial needs, college costs increased faster.

One of the ONLY colleges that saw the insanity of what the government was doing and did something about it was Grove City College in Pennsylvania. But they had to go all the way to the Supreme Court of the United States to fight and maintain their independence! Unbelievable! To my knowledge, very few colleges followed their example and the principles of sound economics.

One of the ONLY colleges that saw the insanity of what the government was doing and did something about it was Grove City College in Pennsylvania. But they had to go all the way to the Supreme Court of the United States to fight and maintain their independence! Unbelievable! To my knowledge, very few colleges followed their example and the principles of sound economics.

Pop Quiz! Name just one of those colleges, and I will send you in US currency what a dollar is worth in gold. (Hint: one of those colleges offers substantive FREE college-level courses online to anyone of any age!)

Therefore, to overcome any debt crisis, we must teach our teenagers fundamental financial literacy, true history across all academic disciplines, and how to think critically with an open, not a closed, mind. I recommend this book as a gift for every teenager: “Think Critically, Think Smarter” by Mark Hartley.