4. Past PFE Posts category archive

Pursuit of the Truth Should be an Ongoing Quest 0

Many of us remember the inspiring words delivered by our 35th President, “Ask not what your country can do for you, ask what you can do for your country.” The Peace Corps was one of JFK’s dreams that is still carried on by not only college graduates but altruistic older adults as well.

Many of us remember the inspiring words delivered by our 35th President, “Ask not what your country can do for you, ask what you can do for your country.” The Peace Corps was one of JFK’s dreams that is still carried on by not only college graduates but altruistic older adults as well.

JFK woke up many independent thinkers of his generation. But his tragically short administration ended on Friday, November 22, 1963, AP US History books barely talk about it other than to say he was the President prior to LBJ who passed the Civil Rights Act of 1964. That Act was the culmination of what JFK started albeit slowly because of Democrat resistance in the south during his Presidency.

Subsequent to his death, many thought (as I did) that JFK had the intent to return our current banking system to the control of the US government, not a central bank controlled by international bankers. This would require changing the way the private Federal Reserve did business or eliminating it altogether, as Abraham Lincoln tried to do before he was assassinated. Unfortunately, that may not be accurate, as this historian points out.

In any case, following his tragic death, many changes took place. One may come as a shock to you. It was the scheme by the Rockefeller and Ford Foundations to promote and fund the women’s ‘liberation’ movement. As a strong supporter of women, I thought that was a good thing. But there were ulterior motives behind what appeared to be a noble effort by the financial backers of the women’s lib movement.

The private banks that own the Federal and State tax-exempt Federal Reserve (watch that superb documentary) needed more citizens to pay taxes. More money they printed (out of thin air) and loaned with interest to Congress needed to be paid back. In the 1950’s it was rare that a mother would have a full-time job outside the home. One parent’s income would cover most family needs. In time, because of increased government borrowing and the resulting devaluation of the dollar, it became necessary for both parents to be working to pay the bills for basic goods and services. It was a strategy that has had a subtle negative short and long-term effect on many families. As a Rockefeller family member revealed to the late highly respected movie producer Aaron Russo, it was designed to do just that.

The private banks that own the Federal and State tax-exempt Federal Reserve (watch that superb documentary) needed more citizens to pay taxes. More money they printed (out of thin air) and loaned with interest to Congress needed to be paid back. In the 1950’s it was rare that a mother would have a full-time job outside the home. One parent’s income would cover most family needs. In time, because of increased government borrowing and the resulting devaluation of the dollar, it became necessary for both parents to be working to pay the bills for basic goods and services. It was a strategy that has had a subtle negative short and long-term effect on many families. As a Rockefeller family member revealed to the late highly respected movie producer Aaron Russo, it was designed to do just that.

Most college students don’t know that the Internal Revenue Service is a de facto government agency. It is simply  the collection agency for the private international bankers that own the Fed. Not a dime of the Federal income tax paid to the IRS goes to the US government. It all goes to the interest on the debt incurred by our Congress that borrowed the fiat currency to pay for various programs; perpetual wars and covert intelligence activities around the globe.

the collection agency for the private international bankers that own the Fed. Not a dime of the Federal income tax paid to the IRS goes to the US government. It all goes to the interest on the debt incurred by our Congress that borrowed the fiat currency to pay for various programs; perpetual wars and covert intelligence activities around the globe.

In July 1944 the world’s leaders met in Bretton Woods, NH to set the US dollar as the world’s reserve currency backed by gold and silver. In 1971 President Nixon, without consulting with other member nations, severed (“temporarily”) that agreement to link the value of the dollar to gold. The ‘golden age’ and credibility of the US dollar was over. This action was not a temporary measure; the global markets were flooded with fiat money which has increased over the years, leading to massive borrowing to fund the abovementioned questionable activities. For example, just the fraudulent war in Afghanistan costs the US 300 million dollars a day! And do not ignore the even more astronomical other costs of war.

Since the declaration of a worldwide Pandemic at the beginning of 2020 many are questioning why the entire global economic system was shut down allowing only “essential” businesses to remain open with restrictions. There have been many pandemics, over the years (remember this one?). As long as you are reading about the importance of education, it is important to learn about your natural immune system and the part it plays in protecting you from an illness; something vaccines will NOT DO, because they are not designed for that purpose in the first place. In fact, there is evidence that what is being called vaccines are NOT vaccines at all. But they are actually experimental gene therapy injections and do NOT meet the CDC-stated characteristics of vaccines. (By the way, none of the thousands of victims from vaccinations given to them for Swine Flu in 1976 reported on the 60 Minutes TV show above, like Judi Roberts, who died in 2010, ever got any financial compensation from the pharmaceutical cartel.)

Since the declaration of a worldwide Pandemic at the beginning of 2020 many are questioning why the entire global economic system was shut down allowing only “essential” businesses to remain open with restrictions. There have been many pandemics, over the years (remember this one?). As long as you are reading about the importance of education, it is important to learn about your natural immune system and the part it plays in protecting you from an illness; something vaccines will NOT DO, because they are not designed for that purpose in the first place. In fact, there is evidence that what is being called vaccines are NOT vaccines at all. But they are actually experimental gene therapy injections and do NOT meet the CDC-stated characteristics of vaccines. (By the way, none of the thousands of victims from vaccinations given to them for Swine Flu in 1976 reported on the 60 Minutes TV show above, like Judi Roberts, who died in 2010, ever got any financial compensation from the pharmaceutical cartel.)

In addition, it is tragic that so-called institutions of “higher” education are still believing all the hype (aka lies and disinformation) and continue to push the allopathic medical/pharmeacuitical narrative. Honest scientific research and little critical thinking still exist there.

Evidence of that is succinctly provided in two recent 30 minute video talks by Dr. David Martin, Ph.D. Watch them both in there entirity before you believe everything on the CFR controlled network news.

There is now talk of a “Bretton Woods II” designed to gradually, but significantly change how business is transacted locally and globally by bringing about what the World Economic Forum officials are calling a “Global Monetary Reset”. Because they know most citizens of the world have limited attention spans they are coming right out with what they plan to do “in plain sight”! The plan is to replace paper money (currently printed out of thin air) with digitized money, also out of thin air, with no gold or silver backing it as it was originally set up in 1944 at the Bretton Woods Conference in N.H.. Even PBS’s Elmo on Sesame Street helps the World Economic Forum prepare children for the great “Global Reset”.

Matthew Blake has an impressive resume and a very slick three-minute presentation using jargon that may “cloud men’s minds” to what Klaus Schwab’s agenda for the “Global Reset” really is. Listen VERY carefully as you: Watch this. He finishes his smooth, albeit abstruse, presentation by ending his PR promo with “At the end of the day…”. A common phrase to soften what basically is a crime against humanity of massive significance to every human on the planet! For a FULL understanding of the true purpose behind the latest pandemic, one needs to sharpen one’s critical thinking skills and read this detailed analysis in its entirety, something, regretfully, most citizens will not do…will you? For a fact-filled video with an international attorney, watch this.

Matthew Blake has an impressive resume and a very slick three-minute presentation using jargon that may “cloud men’s minds” to what Klaus Schwab’s agenda for the “Global Reset” really is. Listen VERY carefully as you: Watch this. He finishes his smooth, albeit abstruse, presentation by ending his PR promo with “At the end of the day…”. A common phrase to soften what basically is a crime against humanity of massive significance to every human on the planet! For a FULL understanding of the true purpose behind the latest pandemic, one needs to sharpen one’s critical thinking skills and read this detailed analysis in its entirety, something, regretfully, most citizens will not do…will you? For a fact-filled video with an international attorney, watch this.

If you have read this far, you may be asking “what can we do?” You have now learned some of the reasons behind this latest virus scare. Now, more of us need to listen to legal scholars, like Peggy Hall, who is being heavily censored by the CFR-controlled media. This interview will help the reader understand what action is now been taking place in various parts of the world and what the average person can do to stop the insane criminal madness.

Yes, there is a solution! (Email or call for the password.) But it requires the opening of our hearts and minds and being aware of our own cognitive dissonance. If that common, albeit limited way of thinking is not recognized, it will be very hard, if not impossible, to “see the big picture” let alone change it for the better. Finally, before you ask for the password to my essay that lays out the solution based on accurate knowledge of history NOT taught in schools or colleges carefully listen to this.

Getting Into the Mind of the Applicant 0

GETTING INTO THE MIND OF AN APPLICANT

Because I have a passion to learn about all forms of alternative healing and disease prevention modalities I once took on the role in 1989 of human pincushion for a student at the New England School of Acupuncture. Come to find out her Dad, a former Boston College professor, was the founder of one of the first firms in the US to successfully build a client base of colleges and show them how to attract teenagers to their colleges. Not only get them to apply, but to fill seats with the highest revenue/seat as possible. I learned a lot from him.

Because I have a passion to learn about all forms of alternative healing and disease prevention modalities I once took on the role in 1989 of human pincushion for a student at the New England School of Acupuncture. Come to find out her Dad, a former Boston College professor, was the founder of one of the first firms in the US to successfully build a client base of colleges and show them how to attract teenagers to their colleges. Not only get them to apply, but to fill seats with the highest revenue/seat as possible. I learned a lot from him.

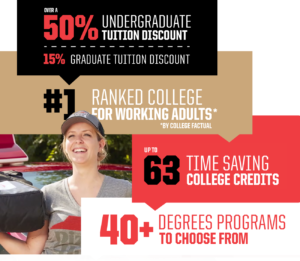

It was his and similar firm’s success that led to the emergence of the Enrollment Manager position in colleges. Many colleges have long devised enrollment strategies to ensure their survival and vie with competitors; now their tactics are much more sophisticated. No enrollment-management tactic is more controversial than the tuition discount. These days, many colleges see the strategic use of so-called merit aid as an essential recruitment tool, a means of  attracting students who can pay all or most of the cost. Nevertheless, the presidents of some small colleges have described the widespread practice as unsustainable and unethical, especially in an era when so many families have ever-increasing financial need.

attracting students who can pay all or most of the cost. Nevertheless, the presidents of some small colleges have described the widespread practice as unsustainable and unethical, especially in an era when so many families have ever-increasing financial need.

But when we opened our college consulting doors in 1992 the Internet was just a weird technology and not understood by most. Even Harvard drop-out, Bill Gates said, it’s just a passing fade a few years before but certainly not today. Teenagers today know more about computers and the myriad of social media sites etc. etc. than I ever will. 🙂 The ways that prospective college students do their research just on their phones is presenting a real challenge to colleges.

That complicates life for the VP of Enrollment Management, whose ability to meet numerous institutional goals, academic profile, and tuition revenue depends on forecasts of how many students will eventually matriculate. The less colleges know about applicants, the hazier their crystal balls become. Who’s serious? Who applied only as a worst-case backup option? Such questions echo across a competitive marketplace as many administrators watch the steady decline of their yield, the percentage of accepted students who enroll.

That complicates life for the VP of Enrollment Management, whose ability to meet numerous institutional goals, academic profile, and tuition revenue depends on forecasts of how many students will eventually matriculate. The less colleges know about applicants, the hazier their crystal balls become. Who’s serious? Who applied only as a worst-case backup option? Such questions echo across a competitive marketplace as many administrators watch the steady decline of their yield, the percentage of accepted students who enroll.

Colleges will continue to waste money by bombarding prospects flyers and brochures, along with the annoying auto-responders, when they start surfing college websites. They use social media a lot too. “It’s so important to my generation,” one student told me, “to see what’s really going on.” But, when I work with students, I will work to bring them back to center and establish solid pragmatic parameters around the college search process. This includes understanding the financial responsibility of their eventual decision by May 1 of the senior year.

Is Getting Into College Easier? 0

Is Getting Into College Easier?

You may have read or heard about how the number of applications have spiked at so-called prestigious colleges around the country. That triggers fear in many households with college bound students. Fear is an often-used emotion to control the actions of people as to what to do (or not do) going forward. Some observers of the college selection process say it is actually easier to get into colleges (even the more competitive ones) than in previous years. Really?

They say that many students do not realize that getting into a good college today is a lot easier, and will become even more so in the coming years. That is the case, according to the Hechinger Report. The writers of the report say it is important to let go of the “fear” mindset because they claim it is one of the reasons why students do not bother to apply to more competitive colleges. Instead, they settle for lower quality schools, when they could have been accepted to much better institutions.

Actually, that is not the case with the students we have been guiding over the last 25 years. They are very much focused on the most competitive colleges, often too much so. When their college list begins to take shape, they are often doing it the wrong way from the top down, rather than the bottom up.

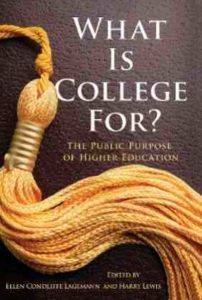

If the reader has college aspirations, you must first think about what is college for and why it is the logical next step for YOU? Though it may become easier to get accepted to college, the same due diligence in finding the colleges best qualified to help you reach your goals is just as important as always. Therefore, even though many colleges and universities may not be that selective, don’t neglect taking the steps that will help you determine if the college to which you apply is qualified to help you reach your goals.

If the reader has college aspirations, you must first think about what is college for and why it is the logical next step for YOU? Though it may become easier to get accepted to college, the same due diligence in finding the colleges best qualified to help you reach your goals is just as important as always. Therefore, even though many colleges and universities may not be that selective, don’t neglect taking the steps that will help you determine if the college to which you apply is qualified to help you reach your goals.

By the way, don’t fall for the well-meaning but misinformed guidance of colleges and some counselors that tell you “Don’t worry about what you want to major in or do for a career. You will have plenty of time to figure that out in college”. If you believe that, read this now.

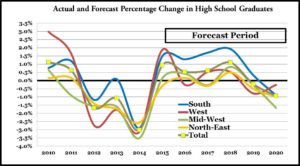

Yes, it may be easier to get into college in the coming years as there will fewer high school graduates until 2023. We are already seeing college Enrollment Managers conceive ways to not only “fill seats” but with the most revenue/per seat.  Many colleges and universities will be increasing their marketing efforts to attract these students. Families might get to finally have (dare I say) the negotiating power. That’s because these institutions compete with each other when it comes to the record number of applicants. You may already have seen how colleges encourage everyone to apply without regard to their qualifications. The more applications they get, the more they can reject, thus moving up in the rankings.

Many colleges and universities will be increasing their marketing efforts to attract these students. Families might get to finally have (dare I say) the negotiating power. That’s because these institutions compete with each other when it comes to the record number of applicants. You may already have seen how colleges encourage everyone to apply without regard to their qualifications. The more applications they get, the more they can reject, thus moving up in the rankings.

The National Student Clearinghouse Research Center‘s said that there’s actually going to be more colleges looking for students, so getting into college is not something students should be worried about. But what I say is, they should be worried about how they are going to pay for it. For that and other answers to your questions, call us.

It’s Not Just About Getting In 0

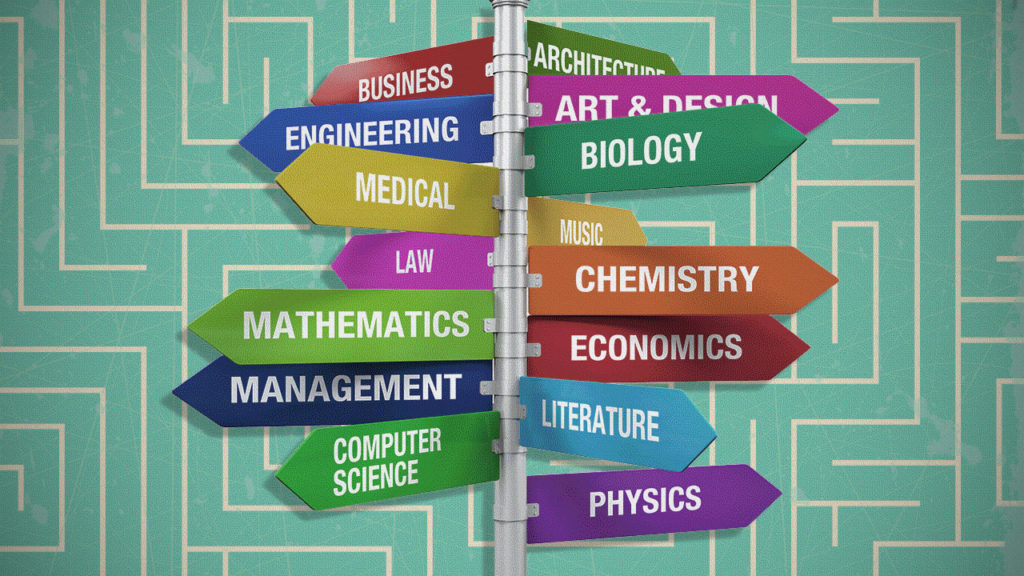

Some students go to college knowing exactly what they want to do. But most don’t. At large state universities, it is not uncommon that over 75% percent of freshmen, even those who have declared a major, say they are uncertain about their major, and half will change their minds after they declare, sometimes more than once. That is one big reason that only 37% of students graduate in four years.

Some students go to college knowing exactly what they want to do. But most don’t. At large state universities, it is not uncommon that over 75% percent of freshmen, even those who have declared a major, say they are uncertain about their major, and half will change their minds after they declare, sometimes more than once. That is one big reason that only 37% of students graduate in four years.

Colleges and universities have vested interests in students declaring early. Retention rates for declared students are better, and they are more likely to graduate in four years. But college officials also recognize that deciding on a major can be overwhelming, especially when coupled with the fear that a wrong choice will result in added semesters and tuition. Especially when coupled with the fear that a wrong choice will result in added semesters and tuition. Students no longer have the luxury of stumbling into a major or making mistakes, not that they ever did.

This requires thinking ahead. Teenagers are not expected to know what to do with the rest of their lives at age 18,  but with coaching, they can cover the bases with prudent planning. Some majors have a curriculum that follows a tight sequence of courses. It’s easier to switch out of engineering than it is to take it up later in the college career.

but with coaching, they can cover the bases with prudent planning. Some majors have a curriculum that follows a tight sequence of courses. It’s easier to switch out of engineering than it is to take it up later in the college career.

The biggest mistake students make is failing to research what’s required of the major, and the profession. Nursing may sound attractive because a student wants to help people, but nursing students take the same demanding math and science curriculum as premed students, and the work is often technical and not for every kindhearted soul. It is also a similar track with Physical Therapy.

More niche filling additions to the list obviously reflect marketplace trends and student demand, like culinary science/culinology, digital arts, and sports communication. At Montclair State University in New Jersey, which offers 300 majors, minors and concentrations, new fashion studies major has been hugely popular, thanks to the university’s proximity to Manhattan; with Madison Square Garden and Giants Stadium in sight. It also guides the ambitious undergrad toward internship opportunities in a sports industry and event-planning major within its business school.

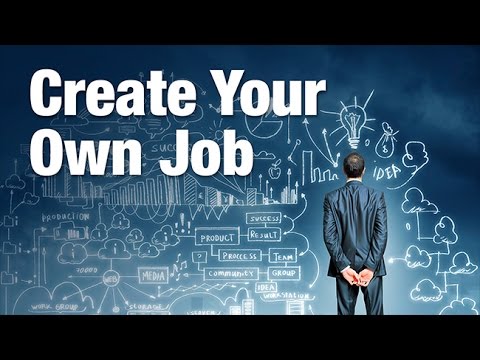

Still, it’s difficult to predict the employment market. That is why I will encourage students to think outside the box. In other words, if the job doesn’t exist…create one. Many students choose majors they think will lead to jobs, but four years from now freshmen will be applying for jobs that don’t even exist today.

Still, it’s difficult to predict the employment market. That is why I will encourage students to think outside the box. In other words, if the job doesn’t exist…create one. Many students choose majors they think will lead to jobs, but four years from now freshmen will be applying for jobs that don’t even exist today.

Most employers are looking for transferable skills the ability to problem solve, work collaboratively, write and speak clearly and think critically. These can be developed in any liberal arts discipline. It makes no sense to suffer through a major because you think it will lead to employment.

In the final analysis, wherever a teenager goes and does after high school, which I call Crossing the Gap Preparing for the Transition, where they go does not matter as much as what they do when they got there.

The late great business philosopher, Jim Rohn, said this “A formal education will make you a living, but self-education will make you a fortune!” These two college graduates understood that. You can too! 1 (978) 820-1295

The Canadian Option 0

The Canadian Option

In recent years, I have written about extraordinary colleges that students know little or nothing about, but should. All but one of those colleges are in the United States. Now I want to discuss higher education opportunities that are north of the border. Have you ever considered the Canadian option? Why not?

In recent years, I have written about extraordinary colleges that students know little or nothing about, but should. All but one of those colleges are in the United States. Now I want to discuss higher education opportunities that are north of the border. Have you ever considered the Canadian option? Why not?

Here are a few reasons why you may want to:

- The quality of education and living standards in Canada are amongst the highest in the world, but the cost of living and tuition fees are generally lower than comparable college costs in the United States. At the time of this writing, $1.00 US equals $1.33 CA. Therefore, the University of Toronto’s cost of attendance (COA) for non-residents is $46,530 (CA) but $35,363 (US). A comparable American university is $65,750. Most of the Canadian universities accept the US Federal loan programs, including the PLUS loan. But they do not accept US Pell or SEOG grants. From an affordability standpoint, this could make the Canadian option impractical because there is little need-based grant aid given to American students to fill the gap.

- There are around 100 major universities in Canada and 95% are publicly supported. There is a high level of respect given to secondary school teachers across the provinces and most students take their lessons seriously and some observers believe they are better prepared for college than their American counterparts. This translates

into a positive peer environment for the mature teenager from the US who is going to college, not because it is the thing to do but to pursue an academic concentration that will prepare them for life beyond college. Learning does not stop after the degree is earned. It is a lifelong activity.

into a positive peer environment for the mature teenager from the US who is going to college, not because it is the thing to do but to pursue an academic concentration that will prepare them for life beyond college. Learning does not stop after the degree is earned. It is a lifelong activity.

- Canada’s high academic standards and rigorous quality controls mean that there is more likelihood of earning a high-quality education that will open doors for your future and benefit your career over the long term. You want to be prepared. A Canadian degree, diploma, or certificate is globally recognized as being equivalent to those obtained from the United States. There are also more CO-OP programs offered than in the US as well as accelerated three-year Bachelors’s degree options. (Keep in mind, however, that if a US graduate degree is pursued, the 3-year degree may not satisfy requirements for some US graduate programs.) Here is the latest ranking of the top Canadian colleges and universities. Now, settle back; grab a hot chocolate and take a virtual tour of them all.

- Study abroad opportunities abound in US colleges. I encourage students to take a semester in another country if it includes taking classes in a university while there. But how about all four years in the foreign country above instead of abroad? With almost all of the world’s ethnic groups represented in Canada, it’s hard not to find ethnic foods and recreation activities associated with specific cultures. Canada has long had a welcome mat out to immigrants from other cultures. They have excellent

screening procedures, but there is little of the fear of “aliens that has been instilled into the US population.

- You may have heard of or experienced Canadians friendly and open nature. During all my visits to Canada, I experienced that friendliness. In fact, the United Nations consistently ranks Canada as one of the best places in the world to live. As an international student in Canada, you’ll enjoy all of the same freedoms which protect Canadians, respect for human rights, equality, and a stable and peaceful society.

By now you may be asking “This looks great but what are my chances of getting in and how complex is the application process?”

Each university has its own application but it is much more straightforward than the Common Application, which only three private schools in Canada accept, by the way. You will need to do your AAA due diligence as you should be doing already. Keep in mind, however, that the admissions person you would have contact with is the International Counselor, not a regional counselor that you will find in private American schools.

Dan Seneker, Student Recruitment Manager at the University of Saskatchewan list the application steps here. Plus a plethora of information and eye-opening statistics here. Finally, here is a link that encapsulates the differences between American and Canadian universities.

Trends Are Watched 0

We Saw Them Coming

At a seminar for college admissions advisers I attended in 1995, Don Bishop who is currently Associate VP of Undergraduate Enrollment at Notre Dame, made some very interesting and accurate observations. One of the important tasks of an Enrollment Manager on a college campus is to look at short term and long term trends in population growth.

Mr. Bishop observed that the year 1999 would be the last year a bright high school graduate could assemble a list of six competitive colleges and be reasonably assured of acceptance somewhere, if not at his first choice, at least at the flagship university in his or her state of residence.

The rapidly increasing birth rate beginning in 1982 (ubiquitous baby boomers being the culprits, once again) have put increasing pressure on the college admission offices. Since the year 2000, the number of college-bound high school seniors has steadily increased each year. In fact, the graduation year 2014 was the largest high school graduating class in American history!

To compound the challenge is the fact the government, particularly the SEC, Congress and the private Federal Reserve have demonstrated a collective lack of oversight and/or fiscal malfeasance. This has further corrupted the fiat credit system that our nation’s economy is based on. The negative impact on family savings and investments has forced more students to look at not just their state universities and colleges but their community colleges. But even these lower cost institutions may not accommodate all of the students applying in the coming years.

The New York Times article points out across the country, many community colleges have felt similar pressures. The battered economy drove many workers back to school to retool their skills, while others have eschewed a four-year degree in favor of a more affordable two-year program.

Therefore, much more deliberate and practical planning will need to be done as a family. Post secondary school planning with us begins with a get acquainted FREE consultation. For more information contact us here.

…continuing the Milestone Step 0

Some students go to college knowing exactly what they want to do. But most don’t. At large state universities it is not uncommon that over 75% percent of freshmen, even those who have declared a major, say they are uncertain about their major, and half will change their minds after they declare, sometimes more than once. That is one big reason that only 37% of students graduate in four years.

about their major, and half will change their minds after they declare, sometimes more than once. That is one big reason that only 37% of students graduate in four years.

Colleges and universities have vested interests in students declaring early. Retention rates for declared students are better, and they are more likely to graduate in four years. But college officials also recognize that deciding on a major can be overwhelming, especially when coupled with the fear that a wrong choice will result in added semesters and tuition. Students no longer have the luxury of stumbling into a major or making mistakes, not that they ever did.

This requires thinking ahead. Teenagers are not expected to know what to do with the rest of their lives at age 18, but with coaching they can cover the bases with prudent planning. Some majors have a curriculum that follows a tight sequence of courses. It’s easier to switch out of engineering than it is to take it up later in the college career.

The biggest mistake students make is failing to research what’s required of the major, and the profession. Nursing may sound attractive because a student wants to help people, but nursing students take the same demanding math and science curriculum as premed students, and the work is often technical and not for every kindhearted soul. It is also a similar track with Physical Therapy.

More niche filling additions to the list obviously reflect marketplace trends and student demand, like culinary science/culinology, digital arts and sports communication. At Montclair State University in New Jersey, which offers 300 majors, minors and concentrations, a new fashion studies major has been hugely popular, thanks to the university’s proximity to Manhattan; with Madison Square Garden and Giants Stadium in sight. It also guides the ambitious undergrad toward internship opportunities in a sports industry and event-planning major within its business school.

Still, it’s difficult to predict the employment market. That is why I will encourage students to think outside the  box. In other words if the job doesn’t exist…create one. Many students choose majors they think will lead to jobs, but four years from now freshmen will be applying for jobs that don’t even exist today.

box. In other words if the job doesn’t exist…create one. Many students choose majors they think will lead to jobs, but four years from now freshmen will be applying for jobs that don’t even exist today.

Most employers are looking for transferable skills the ability to problem solve, work collaboratively, write and speak clearly and think critically. These can be developed in any liberal arts discipline. It makes no sense to suffer through a major because you think it will lead to employment.

In the final analysis, wherever a teenager goes and does after high school, which I call Crossing the Gap: Preparing for the Transition, where they go does not matter as much as what they do when they got there.

The late great business philosopher, Jim Rohn, said this “A formal education will make you a living, but self-education will make you a fortune!” These two college graduates understood that. You can too! 1 (978) 820-1295

Fifteen Extraordinary Colleges 0

Five Extraordinary Colleges You’ve Never Heard of until Now

In our offices we have large North American maps with the locations of most all the colleges in the U.S. and Canada. It is always fun to place a pin into the map where a student of ours matriculated but never knew existed before meeting with us.

In our offices we have large North American maps with the locations of most all the colleges in the U.S. and Canada. It is always fun to place a pin into the map where a student of ours matriculated but never knew existed before meeting with us.

In of the Extraordinary Colleges You Never Heard of Until Now series, Deep Springs College in California was one of those colleges. In my opinion, it was Shimer College in Chicago, one of the most unique colleges in the U.S., to receive a pin. I hope you read the first two installments above if you haven’t already.

As seniors wait to hear from all their colleges to which they applied it is now time for juniors and sophomores to continue the exploratory process. We are going to begin our next college road trip in the beautiful state of Maine in one of the most sought after vacation spots in the Northeast Bar Harbor, Maine, the epitome of New England charm.

There, smack dab on the Atlantic Ocean you will find The College of The Atlantic. Eat your hearts out Southern California! The beauty and historic significance of the Maine coast puts the boring sun drenched Pacific beaches and ubiquitous shopping centers to shame. Mount Desert Island was a summer escape for wealthy families looking to get away from the heat of the cities. Today, a little Gilded Age charm still exists. A stone castle built in 1895, now acts as College of the Atlantic’s main administrative building, while other homes have been purchased and renovated into residence halls.

Amazingly, the College’s 350 or so independent, bright, committed and VERY environmentally conscious students consider Acadia National Park as their backyard and personal research laboratory. Ask any one of them what their degree is in and they will tell you Human Ecology! I love that! When you understand what it is, maybe you will too.

Amazingly, the College’s 350 or so independent, bright, committed and VERY environmentally conscious students consider Acadia National Park as their backyard and personal research laboratory. Ask any one of them what their degree is in and they will tell you Human Ecology! I love that! When you understand what it is, maybe you will too.

continuing our road trip… 0

Remember, this is a tour of extraordinary colleges; therefore different pedagogical methods may not be for you. That is okay, enjoy the trip, the ride will be educational. But for those students who fit the profile, the education one receives is rock solid (no pun intended).

Now, let’s hop into our rented Nissan e-NV200 Electric van and head across New Hampshire to my favorite state of the Union, Vermont. Nestled up in the Northwest corner overlooking gorgeous Lake Champlain is Champlain College. The city of Burlington is the home of two other colleges. One is the most expensive public university in the country, U of Vermont and the other is St Michaels College.

Now, let’s hop into our rented Nissan e-NV200 Electric van and head across New Hampshire to my favorite state of the Union, Vermont. Nestled up in the Northwest corner overlooking gorgeous Lake Champlain is Champlain College. The city of Burlington is the home of two other colleges. One is the most expensive public university in the country, U of Vermont and the other is St Michaels College.

We are here to visit Champlain. Founded in 1878 it now has 2,396 happy to be here students. It has come into the 21st century with a strong endowment and financially prepared to offer innovative and pragmatic courses of study based on its’ “Upside-Down Curriculum” that are very much designed for the graduate to be highly employable in many fields upon graduation. In fact, 98% of them are employed in careers related to their majors  within two years.

within two years.

Watch the many videos that the communications majors have produced. Here are some students. As more than a few students will say, “You will work hard in your courses, but you will take away so much more than you ever expected. The professors will not let you slip through the cracks, and you will learn more about yourself and the world around you in even the most academic of classes.”

Now we have to take to the air and fly from Burlington to Charlotte, North Carolina. We then drive to High Point, North Carolina to a university, founded in 1924, that would never have been included on this list of extraordinary colleges before 2005.

It was in 2005 that the High Point University trustees asked, encouraged, cajoled, begged and finally convinced Dr. Nido Quebin to become its President. What he has done in the last 10 years is incredible. Read and view the many interviews he has had since he took over. Took over are the wrong words. He has inspired faculty and students alike to be the best they can be. His style of positive leadership sparkles when he speaks. The focus is on the student and I marvel at his ability to bring all the academic departments together with a common mission.

It was in 2005 that the High Point University trustees asked, encouraged, cajoled, begged and finally convinced Dr. Nido Quebin to become its President. What he has done in the last 10 years is incredible. Read and view the many interviews he has had since he took over. Took over are the wrong words. He has inspired faculty and students alike to be the best they can be. His style of positive leadership sparkles when he speaks. The focus is on the student and I marvel at his ability to bring all the academic departments together with a common mission.

At this time, the school is not that well known outside of the Southeast, but that is about to change. It is definitely worth a strong look regardless of your prospective major there is something for everyone.

Of the many videos, be sure to set aside one hour to watch this one: ENTREPRENEURSHIP ROUNDTABLE DISCUSSION

Our next stop is Pennsylvania. We are going to visit Grove City College 60 miles north of Pittsburgh. This is a very competitive liberal arts college with particularly strong pre-medicine, engineering and business programs. So, what is so extraordinary about that? You ask.

When parents ask me, “Why is college so expensive and why have costs, risen, on average, 2 to 3 times faster than inflation since the 1970’s?”, I point to Grove City College for the answer.

When parents ask me, “Why is college so expensive and why have costs, risen, on average, 2 to 3 times faster than inflation since the 1970’s?”, I point to Grove City College for the answer.

In 1972 the newly created Department of Education during the Carter administration, advocated for strong legislation that would make colleges, who wished to use any kind of Federal Aid in their financial aid packages, to meet complex gender equity requirements on their campuses. It was called Title IX. Over the years, the cost of complying with those rules has brought about ever increasing administrative costs.

Grove City keeping with its independent conservative principles cried foul! They did not want the education they provided to the undergrads be compromised by having to be encumbered with additional expenses that had nothing to do with education. Of over 4000 colleges, Grove City was the lone cry for sanity and critical thinking in the world of higher education.

However, they had to go all the way to the Supreme Court in 1984 to  maintain their independence from Federal control. The landmark case is truly one for the history books! Watch the video in its’ entirety above. They have since been able to keep costs under control. The COA in 2015/16 is less than $27,000/year. The college is debt free and self-funds programs to provide both need based and merit scholarships to those who qualify. They do all this without paying their professors any less than comparable colleges, having students sleep in bunk houses, eat canned tuna or limit its athletic programs to co-ed croquet and ultimate Frisbee competitions.

maintain their independence from Federal control. The landmark case is truly one for the history books! Watch the video in its’ entirety above. They have since been able to keep costs under control. The COA in 2015/16 is less than $27,000/year. The college is debt free and self-funds programs to provide both need based and merit scholarships to those who qualify. They do all this without paying their professors any less than comparable colleges, having students sleep in bunk houses, eat canned tuna or limit its athletic programs to co-ed croquet and ultimate Frisbee competitions.

Founded in 1876 it is a very traditional Presbyterian college and church attendance is required. But that may not be a bad thing. Do you agree?

Whoops! What time is it? We better get to the airport, our flight leaves for San Francisco in two hours. The last college on our tour has made the list in large part because of its President, Dr. Pamela Eibeck, Ph.D. The University of the Pacific had been a very good medium size undergrad school for decades but when she took the helm at the same time her son became a college freshman at Santa Clara, refreshing changes rejuvenated the campus that, like many others, had become a bit stagnant. (Fun Fact: Read about why her son was disappointed his mom got the job.)

Whoops! What time is it? We better get to the airport, our flight leaves for San Francisco in two hours. The last college on our tour has made the list in large part because of its President, Dr. Pamela Eibeck, Ph.D. The University of the Pacific had been a very good medium size undergrad school for decades but when she took the helm at the same time her son became a college freshman at Santa Clara, refreshing changes rejuvenated the campus that, like many others, had become a bit stagnant. (Fun Fact: Read about why her son was disappointed his mom got the job.)

When I tell promising students in the Northeast about this college called the University of the Pacific their eyes light up! Wow, I have heard so much about the great surfing out there. I don’t tell them  right away that the Stockton campus is two hours drive to some of the best surfing anywhere in California, Santa Cruz. I want them first to think about why they are going to college for the academics, right?

right away that the Stockton campus is two hours drive to some of the best surfing anywhere in California, Santa Cruz. I want them first to think about why they are going to college for the academics, right?

Speaking of academics, you will not be disappointed at UOP. Because Dr. Eibeck was Dean of Engineering at a Texas University before coming to UOP, that department is tops but her academic; analytic and leadership skills have strengthened all academic departments. Like Dr. Quebin of High Point University, she has inspired the entire faculty and student body to work as a team and do the best they can for themselves and for each other.

Speaking of academics, you will not be disappointed at UOP. Because Dr. Eibeck was Dean of Engineering at a Texas University before coming to UOP, that department is tops but her academic; analytic and leadership skills have strengthened all academic departments. Like Dr. Quebin of High Point University, she has inspired the entire faculty and student body to work as a team and do the best they can for themselves and for each other.

Thank you for traveling this far with me. By the way, please send me an email if you have an extraordinary college that deserves to be highlighted. I know there are more than the 15 I have discussed on this Blog. I will be including some Canadian and Universities around the globe in future installments. (By the way, what did you think of the European College in my second essay?) 🙂

If you have a high school student with college aspirations or simply needs some guidance even if college is NOT the next step, give me a call @ (978) 820-1295. Smart College Planning begins with a complimentary “get acquainted” 75′ conversation.

Five MORE Extraordinary Colleges 0

Five Extraordinary Colleges You’ve Never Heard of but Should

In our offices we have large North American maps with the locations of most all the colleges in the U.S. and Canada. It is always fun to place a pin into the map where a student of ours matriculated but never knew existed before meeting with us.

In our offices we have large North American maps with the locations of most all the colleges in the U.S. and Canada. It is always fun to place a pin into the map where a student of ours matriculated but never knew existed before meeting with us.

In the “Extraordinary Colleges You Never Heard of but Should” series, Deep Springs College in California was one of those colleges. In my opinion, it was Shimer College in Chicago, one of the most unique colleges in the U.S., to receive a pin. I hope you read the first two installments above if you haven’t already.

As seniors wait to hear from all their colleges to which they applied it is now time for juniors and sophomores to continue the exploratory process. We are going to begin our next college road trip in the beautiful state of Maine in one of the most sought after vacation spots in the Northeast…Bar Harbor, Maine, the epitome of New England charm.

There, smack dab on the Atlantic Ocean you will find The College of The Atlantic. Eat your hearts out Southern California! The beauty and historic significance of the Maine coast puts the boring sun drenched Pacific beaches and ubiquitous shopping centers to shame. Mount Desert Island was a summer escape for wealthy families looking to get away from the heat of the cities. Today, a little Gilded Age charm still exists. A stone castle built in 1895, now acts as College of the Atlantic’s main administrative building, while other homes have been purchased and renovated into residence halls.

Amazingly, the College’s 350 or so independent, bright, committed and VERY environmentally conscious students consider Acadia National Park as their backyard and personal research laboratory. Ask any one of them what their degree is in and they will tell you Human Ecology! I love that! When you understand what it is, maybe you will too.

Amazingly, the College’s 350 or so independent, bright, committed and VERY environmentally conscious students consider Acadia National Park as their backyard and personal research laboratory. Ask any one of them what their degree is in and they will tell you Human Ecology! I love that! When you understand what it is, maybe you will too.