5. Undergraduate category archive

Generations 0

Fifteen years ago two professors at Beloit College in Wisconsin published a list of observations they determined to be characteristic of the entering freshman that would be graduating in 2002. It went viral soon after that and became a greatly anticipated annual event in certain academic circles. It is funny, it is eye-opening and it is scary!

Fifteen years ago two professors at Beloit College in Wisconsin published a list of observations they determined to be characteristic of the entering freshman that would be graduating in 2002. It went viral soon after that and became a greatly anticipated annual event in certain academic circles. It is funny, it is eye-opening and it is scary!

For instance, if you were born post 1995, having a chat seldom involved talking. Java has never been just a cup of coffee; the US has always imposed economic sanctions against Iran; you never attended a concert in a smoke filled arena and rights of passage had more to do with when you got your own cell phone or Skype account than getting a drivers license or car.

The list that will characterize the high school Class of 2014 (that will graduate college in 2018) has not been released yet, but if it will be as terrifying as last years. YIKES!

What an interesting sociological study of the ever changing generational changes.

As a student of a certain era, I look back and reminisce from time to time. It is fun to do that isn’t it? I know that social scientists have put labels on various populations since the twenties.

In what year were you born? How well do you fit within that period of that time?

- 1928 to 1945 ~ The Silent Generation (Some might say the greatest.)

- 1946 to 1964 ~ The Baby Boom Generation

- 1965 to 1980 ~ Generation X

- 1981 to 2002 ~ The Millennial Generation

Now, it may be easy to place yourself into one of those chronologically but if you want to know how you truly fit in a particular generation, I suggest you take the 14 question POP quiz below. 🙂

I took it and found it uncannily accurate. Find out for yourself here.

Presently, all of our students are part of the Millennial Generation and most (but not all) of their parents are Generation X. Holy coffin nails Batman! None of them were alive when JFK was killed. Do they even know what JFK was planning on doing as President? How much have they learned about history in AP History? I hope more than I think based on the annual survey below.

Are you ready for this? Of course you are. Let me know what you think you could add to the list.

Crossing the Gap ~ Preparing for the Transition 0

In the post WW II era of the early 50’s there were approximately 3 million college students; now there are 20 million. A college degree which used to be seen as a luxury, something which would, in a lifetime, enrich and enlighten….is now seen as a ticket to a bigger paycheck. Colleges, supported by the College Board and politicians in the District of Columbia, continue to say that a Bachelor degree is worth over 1.3 million dollars more in earnings than a high school diploma. Look at the report published by Georgetown University’s Center on Education and the Work Force.

In the post WW II era of the early 50’s there were approximately 3 million college students; now there are 20 million. A college degree which used to be seen as a luxury, something which would, in a lifetime, enrich and enlighten….is now seen as a ticket to a bigger paycheck. Colleges, supported by the College Board and politicians in the District of Columbia, continue to say that a Bachelor degree is worth over 1.3 million dollars more in earnings than a high school diploma. Look at the report published by Georgetown University’s Center on Education and the Work Force.

But now we hear that the undergraduate degree is not enough and that an increasing number of graduates are unemployed or underemployed. If that is true, why is it true?

But now we hear that the undergraduate degree is not enough and that an increasing number of graduates are unemployed or underemployed. If that is true, why is it true?

- Are employers raising the proverbial bar for advancement or even entry level jobs within the organization?

- Is it because colleges are graduating students with little more knowledge or critical thinking skills than they had in high school ?

- Or is it because college graduates are not prepared to enter the work force because they have had little or no substantive work experience while they were college students?

Many would blame the “economy”. Yes, we hear a lot in the news about jobs being scarce because of the great recession. But we are not told why. I suggest it is because our Keynesian economic system, based on fiat currency and debt, has been subtlety used to manipulate trends of booms and busts in the economy since 1913 and was accelerated in 1971 when the dollar was taken off the gold standard. Currently, there is statistical evidence that the graduating college and high school class of 2013 continue to face dim job prospects. It is one of the symptoms of the excess borrowing and inflationary spending.

Despite that reality check, there is good news for the undergraduates here. 🙂

Newly minted college graduates (and parents) have made significant down payments on their futures in terms of both time and money, and they typically have a considerable burden of debt right out of the gate. If that graduate did not investigate the career services department beginning in the freshman year (preferably when they were still in high school) he or she may have missed getting the internship or co-op experience needed to optimize employment prospects.

Newly minted college graduates (and parents) have made significant down payments on their futures in terms of both time and money, and they typically have a considerable burden of debt right out of the gate. If that graduate did not investigate the career services department beginning in the freshman year (preferably when they were still in high school) he or she may have missed getting the internship or co-op experience needed to optimize employment prospects.

If you are an undergraduate now or thinking about going to college, look around your community. Is there something you see that is being done (legally) 🙂 by someone that not only looks interesting but enjoyable and …dare I say fun? Though you may not be able to tell at first, are they earning an income that supports their life style?

Take an honest assessment of your natural strengths and innate characteristics. (If you have done that work with me already, return to the computer where you have made it a favorite.) Research that work that looks like fun and learn what it will take to do it. By the way, did you know that the best definition of workis NOT in the dictionary? Here it is.

Work (wurk) n. ˜something you do when you would rather be doing something else”

Is that a Utopian ideal? Not necessarily.

If you are a whiz in math or science that does not mean you should be an engineer, mathematician or doctor. Your peers, relatives and teachers may say so, and they may be right. But I don’t have enough fingers and toes to count the number of adults I know who are now self-employed with time freedom to spend doing things they never dreamed they could do and spend time with their families all while writing their own paycheck. The work they are doing may even be unrelated to what their college major was. Learn from the learning curve of adults and college students like these who have walked the path ahead of you and changed their destinies by focusing on doing, not wishing.

If you cannot find your dream job why not create one! As a matter of fact, forget about a job for a moment. After all, did you know that JOB is an acronym for Just Over Broke. Jim Rohn, the late great business philosopher and mentor for millions of successful entrepreneurs said, “Formal education can help make you a living, but self-education will make you a fortune.”

He was a master with words and ‘walked the talk’ by doing. We ALL have the ability to change, but as Jim Rohn said in another memorable quote, “If you really want to do something, you will find a way; if you don’t you will find an excuse. If you would like some help or simply assurance that you are on the right track, give us a call. No more excuses. 🙂

Eric Goodhart ~ (978) 820-1295

What is College For? 0

As we enter the second semester of the academic year, millions of high school students are anxiously awaiting college acceptance letters. Some have heard already from those colleges. The students who applied in a college’s ED, EA or rolling admissions program. But the most competitive colleges will not make their final decisions until late March for the RA pool of applications.

As we enter the second semester of the academic year, millions of high school students are anxiously awaiting college acceptance letters. Some have heard already from those colleges. The students who applied in a college’s ED, EA or rolling admissions program. But the most competitive colleges will not make their final decisions until late March for the RA pool of applications.

Other than those students who were accepted in December in an ED program, all other students will have until May 1 to make their final decisions. Before that deadline it is the colleges that will be nervous. That is, who will say Yes, I am accepting your acceptance back to them! In the college ratings game made popular by US News & Reports, the higher the yield the higher the ranking.

Yes, it is an exciting time. But let’s step back a minute and consider this. What is college for anyway? Is it REALLY worth the expense? Colleges will tell you it is an investment. But in financial jargon an investment is made in anticipation of an outcome greater than the time or money put into it. Is that what the outcome is in the majority of cases?

In May of 2011, the Pew Research Center released surveys that indicate that 57% of Americans feel that universities in the US fail to provide good value for the money spent. College has always been expensive but in the last 21 years I have seen an escalation of costs that are way out of proportion with income, with one significant exception. Parents view college price tags with a wary eye, as they should. According to the survey only 35% of the American adult public said colleges were doing a good job in terms of providing value to students; 42% said only fair and 15% said poor. In the same survey, however, 84% of recent college graduates said college had been a good investment; only 7% said it had not been.

Why the disparity in belief? Is that because young people don’t want to admit the four years plus they spent in college was money (more often a parent’s money) not well spent? What I sense some of them saying is that the benefits they received are intangible, immeasurable and not connected to what a particular degree got them.

Hopefully, as teenagers mature through their twenties they develop a fair amount of critical thinking and social networking skills. They will benefit greatly from learning as much, if not more, outside the classroom as in it. That is why I put a great deal of emphasis on understanding the nature and depth of academic and career advising at each college they are considering. The student who is pro-active in pursuing internships as an undergraduate often has an advantage amongst his peers following graduation.

Call us at Programs for Education for a complimentary get acquainted conversation. Learn how you and your children can get the best return on investment from their college experience.

Key Steps to Success 0

A college education has long been viewed as a ticket to a better quality of life. Though it is truly a milestone decision in a young person’s life it does not necessarily mean that a particular college decision will have the highest rate of return in achieving life goals. Unfortunately, some students do not think clearly about this decision, buying the brand name college and taking on large amounts of debt.

A college education has long been viewed as a ticket to a better quality of life. Though it is truly a milestone decision in a young person’s life it does not necessarily mean that a particular college decision will have the highest rate of return in achieving life goals. Unfortunately, some students do not think clearly about this decision, buying the brand name college and taking on large amounts of debt.

For students who don’t want to have daunting repayment obligations, without a solid income opportunity consider this:

- Know the average amount of debt that students carry at each of your potential colleges. Check out college-insight.org for such information.

- Complete a money-saving Dry Run before you even have a final list of colleges in mind.

- Discuss with counselors and advisors what majors to consider and understand how your natural strengths and innate characteristics fit related careers.

- Earn and save money during college. Many bright students are earning over $1000/month part-time while in college without sacrificing their academic responsibilities. Call Eric and he will show you how they are doing it.

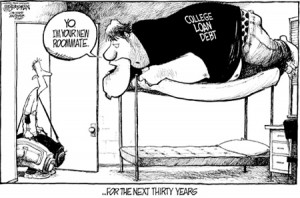

“Excessive student debt, often made without an explicit decision on its impact on future life choices, not only restricts traditional career choices but the basic ability of young people to take risks requiring them to defer their dreams,” says Robert Shireman, executive director for the nonprofit Project on Student Debt.

According to the Project on Student Debt, the average 2010 graduate carried $25,250 in loans. (Not to mention what the parents have borrowed.) The big galoot above says to the young graduate, “Yo! I am your new roommate…for the next thirty years.”

Astrid Neilson, a 23-year-old who graduated from the University of Virginia, assumed a huge financial burden to attend a public university as an out-of-state student. Her life is definitely impacted by the $90,000 college debt from the college. (Some were signature loans from a relative.) I really want to go to law school, but can’t unless I get a scholarship. Possible, but not likely.

Neilson did not consider future income before assuming her loans, although she anticipated always working in the nonprofit or public sector. Her choices confirm a recent survey by student-loan provider Sallie Mae that post-graduate income was not a factor for an incredible 70 % of students and parents in determining how much to borrow to finance a college degree. (Can you say Dry Run?)

So after the glossy college brochures arrive in the mail and the visits to leafy college campuses are over, students need to ask themselves: Can I afford this school without excessive borrowing? If money saved falls short, consider living at home for two years, get the necessary pre-requisites out of the way at a community college and transfer to your state or private university. Be smart now and financially independent later.

So after the glossy college brochures arrive in the mail and the visits to leafy college campuses are over, students need to ask themselves: Can I afford this school without excessive borrowing? If money saved falls short, consider living at home for two years, get the necessary pre-requisites out of the way at a community college and transfer to your state or private university. Be smart now and financially independent later.

Do not like that option? Then you should read The Millionaire Next Door.

Real World Preparation 0

Anyone who has ever been on a job interview will tell you, one of the first questions an interviewer will ask is; What kind of experience have you had that has prepared you for the position?

Anyone who has ever been on a job interview will tell you, one of the first questions an interviewer will ask is; What kind of experience have you had that has prepared you for the position?

If you are a recent college graduate and aspire to be employed (for example) as a financial analyst for a growing international company like this one, will you be able to say, Yes, thank you for asking. The two summers, while in college, working for Bain & Company in Boston inspired my decision to work for a company that has strong growth potential not only in the North American market but internationally as well.

Having already done research into the company to which you seek employment, you go on to say, I earned my BA in International Business with an emphasis on economic policy. I am also fluent in both German and Mandarin Chinese, countries in which you do business. The work I did in a collaborative team environment was to analyze the financial reports of companies to determine the areas of strength and weaknesses. We then would make proposals to make the necessary changes to replace the weaknesses with vital improvements for the short and long term.

Or will you be saying to a future employer, (because you did not take advantage of any substantive internships during college). Well, I managed the Trading Post Snack Bar at Camp Tip-A-Canoe in Vermont for two summers. At the end of the summer I showed a profit of at least $194.25 from the sale of all the cookies and candy sold to the campers.

during college). Well, I managed the Trading Post Snack Bar at Camp Tip-A-Canoe in Vermont for two summers. At the end of the summer I showed a profit of at least $194.25 from the sale of all the cookies and candy sold to the campers.

Listen up! It is not too late. There is good news for the current undergraduate here. Internships provide short-term practical experience for students and recent graduates. They may be located anywhere in the world. Check with you college career services office. In fact, a college student should know what that office does starting in the freshman year. Though many internships will be done in the summer following the junior year, the ambitious student will research and apply for one before the end of the sophomore year.

Take a look at what one enterprising student did. She saw a need and filled it! She is now known as the Intern Queen. Learn from her. By the way, you can probably guess what her personality archetype is, can’t you?

Take a look at what one enterprising student did. She saw a need and filled it! She is now known as the Intern Queen. Learn from her. By the way, you can probably guess what her personality archetype is, can’t you?

According to a recent survey by the National Association of Colleges and Employers, employers reported that, on average, more that 3 out of 5 hires had internship experience. Many employers hire directly from their internship programs.

Career counselors, books, and other resources can be helpful in the application and interview process. In fact, if you are an undergraduate or even out of college and still not sure the direction you wish to take, call us at (978) 820-1295. Let’s discuss the options that will save you time and aggravation.

A History Lesson 0

You cannot solve a problem with the same thinking that created the problem.

That quote has been attributed to Albert Einstein. I am not sure in what context he said that, but when it comes to the current escalation of student and parent debt, there could be a lesson to be learned. One does not have to look far to recognize that there is a problem. To solve the problem, therefore, we must NOT rely on the same thinking by the people (or institutions) that created the problem.

That quote has been attributed to Albert Einstein. I am not sure in what context he said that, but when it comes to the current escalation of student and parent debt, there could be a lesson to be learned. One does not have to look far to recognize that there is a problem. To solve the problem, therefore, we must NOT rely on the same thinking by the people (or institutions) that created the problem.

When the world was getting back on its feet following World War II there was huge expansion in the US economy. As in WWI, the nation was not subject to the civilian genocide and property destruction in Europe, Asia and elsewhere. We were seen as the leader of the western world.

In fact, in July of 1944, 760 delegates from 44 countries met in Bretton Woods, New Hampshire at the Mt Washington Hotel to set monetary policy for the civilized world. The delegates agreed upon a monetary policy that set the US dollar (backed by gold and silver), as the standard for world currency. From that event came the International Monetary Fund (IMF) and the system of exchange rate management was set up.

That system stayed in place until the country overspent during the “guns and butter” decade of the 60’s. The decision was made to take the dollar off the gold standard in 1971. Watch this short historic video when President Nixon announced that action. That marked a significant issuance of fiat currency (money created out of thin air) by the Federal Reserve, a devaluation of the dollar and ever-increasing debt.

I know it may be a fantasy of mine, but I suggest that we teach basic money management in every high school. Many students who major in economics in U.S. colleges do not even understand the exponential value of money. Nor do they know as much as this bright 12 year old has already learned in Canada. I once interviewed a graduate of Harvard for a management position I had. He majored in Economics and when I asked him if he could explain the Rule of 72 as it relates to money, he did not know what I was talking about!

The problem is that we are a society that does not save, we spend. Saving, not spending grows the economy. This is not what we are taught in school. Believing that a college education is a right (or even a necessity) is putting our kids into debt. If college is the next milestone step in a teenager’s life, he or she should understand how that financial decision will impact his or her future. So many college graduates have the rule of 72 working against them rather than for them. Over the last 25 years I have watched college costs escalate at higher than the rate of inflation. As the federal and state governments made more grants and loans available for colleges to use to fill a family’s financial need, the faster college costs went up.

The ONLY college that saw the insanity of what the governments were doing and did something about it, was Grove City College in Pennsylvania. But they had to go all the way to the Supreme Court of the United States to fight and maintain their independence! Unbelievable. Only two other colleges to my knowledge followed their example and the principles of sound economics.

The ONLY college that saw the insanity of what the governments were doing and did something about it, was Grove City College in Pennsylvania. But they had to go all the way to the Supreme Court of the United States to fight and maintain their independence! Unbelievable. Only two other colleges to my knowledge followed their example and the principles of sound economics.

Pop Quiz! Name those two colleges and I will send you in US currency what a dollar is worth in gold.

Therefore, in order to get out of this looming debt crisis, we have to teach our kids real financial literacy beyond how to balance a check book and not rely on government for solutions to an economic challenge including paying for college.

“Houston…We Have A Problem.” 0

That cryptic phrase was the actual message sent by Astronaut, Jack Swigert on April 13, 1970, to NASA Mission Control in Houston, Texas. As you will see here, it was definitely a problem. The rocket was over 200,000 miles from earth and heading toward the moon when an huge explosion occurred on board. The process by which the rocket was turned around using brilliant engineering tactical skills resulting in a successful return back to planet Earth was miraculous.

That cryptic phrase was the actual message sent by Astronaut, Jack Swigert on April 13, 1970, to NASA Mission Control in Houston, Texas. As you will see here, it was definitely a problem. The rocket was over 200,000 miles from earth and heading toward the moon when an huge explosion occurred on board. The process by which the rocket was turned around using brilliant engineering tactical skills resulting in a successful return back to planet Earth was miraculous.

The question is: Does America have the brainpower today to meet such challenges?

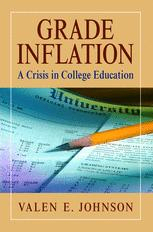

Now that I have your attention, let us consider the problem. The immediate problem we have has to do with the lowering of academic standards in our schools (and colleges) over the last 40 years. What kind of preparation do high school students get for college or for life in general, for that matter?

More and more American colleges have incoming freshmen that are flat out not prepared for college-level work. Even professor’s at the most competitive Ivy League schools see the diminishing writing, reading, and critical thinking skills their students have. Why is that?

For an in-depth answer to that question, you can read the insightful, exhaustive, and extensive research by Charlotte Iserbyt. Her tome, The Deliberate Dumbing Down of America is where to start.

There is a myriad of good solutions to the problem. But like most things, it will need a consensus that there is a problem and an interest in the solutions. A teacher’s ability to teach is obviously important. But teaching a classroom of diverse personalities is not easy. It takes a special person who has the passion and ability to teach and inspire effectively. As I talk with high school students, I learn that their interest in various subjects often depends upon the teacher’s ability to engage and motivate them. It may not even be a subject they had an interest in before taking the class. Are you a student? Is that true?

Another challenge that principals and superintendents have is that school systems are required to meet the state and federal rules and regulations of the Departments of Education. Ms. Iserbyt does an excellent job of pointing out the problems there. Do you think that the government may have overreached and put both the teachers and students at an extreme disadvantage?

Parents should learn if the curriculum being taught is what the student needs to learn. Is it time to ABOLISH the Federal Department of Education and return education planning to the states, and more importantly the school districts? Admittedly, it will be extremely tough because most school administrators and parents have gone through the indoctrination that needs to be changed. But the interview here is where to not only see the problem but how to solve it.

In the final analysis, isn’t learning a lifelong activity? As Saint Augustine once wrote, “The world is a book, and those who do not travel, read only one page. Think about how you can leave the world better than you found it when you arrived. (Email or call for the password.)

Even Colleges Are Budget Conscious 0

From Boston University to California’s 3 million-student community college network, the American system of higher education is in turmoil. The economic crash is upending each step in the equation that families use to determine where students will spend four of their most formative and expensive years.

From Boston University to California’s 3 million-student community college network, the American system of higher education is in turmoil. The economic crash is upending each step in the equation that families use to determine where students will spend four of their most formative and expensive years.

Independent colleges that lack a national name or must-have majors are hardest hit. Many have found themselves deep in debt in an effort to remain competitive. They are becoming more conscious of a student’s ability to pay during the admissions process. (Despite what a representative may say at a college fair or when you visit a campus.) Now, as endowments tumble and bills mount, they’re struggling to attract cash-strapped families who are challenged with their own financial situations.

The spending binge by colleges and universities was part of the same trend that created the bubble in the rest of the economy, says Ronald Ehrenberg, an economics professor at Cornell University in Ithaca, New York, and author of Tuition Rising: Why College Costs So Much (Harvard University Press, 2000). Now we’re seeing it burst.

Professor Ehrenberg does not place enough focus, however, on the ever expanding reliance on federal loans and grants that are made available from federal tax payers to fill financial need packages. This includes the expanding use of debt crippling Plus Loans. Instead, he writes more about the escalation in costs because of increased spending (borrowing) to enhance student amenities and other unnecessary expansion of the infrastructure. That is true, but one only needs to look at an academically strong liberal arts college in Pennsylvania to see how much money can be saved when a college does not depend on government subsidies. (Less than five accredited colleges are truly independent.)

Grove City College does not participate in the federal loan or grant program. That is a big reason why the full cost of attendance there in 2014/15 is less than $26,000! It is not because they pay their professors less, have students sleeping on cots in bunk houses or do not offer financial aid; it is because they do NOT use federal financial aid. As I hope you know, there is an enormous mismanagement of money in most government programs. That is a characteristic of a multi-layered bureaucracy; it is often replete with redundancies and waste. For instance, in order to meet the eligibility requirements to use Stafford, Perkins, Plus loans and Pell and SEOG grants, colleges have huge administrative expenses that have nothing to do with educating your son or daughter.

All the more reason to approach the college planning process realistically. If you are just beginning the process you should know that smart college planning begins with a free consultation. During that time you will learn what steps you can take on your own to avoid the pitfalls of picking the college that is in financial trouble and cutting back on programs and professors. Clearly, these will have a negative effect on the time and money spent pursuing a degree in the appropriate major.

Standard & Poor’s predicts bankruptcies will rise from the typical one or two schools that fold each year. Small colleges with no reputation could go out of business, says Sandy Baum, a senior policy analyst at the College Board, They are very tuition-driven, so if they cannot get tuition revenues, they will be in really bad shape. In addition, Richard Kneedler, a former president of Franklin & Marshall College, a Lancaster, Pennsylvania-based college founded in 1787 with financial support from Benjamin Franklin, says many small schools face this predicament. Therefore, buyers beware.

Teacher and/or Professor Recommendations 0

An important part of most college applications is often not taken seriously enough. Colleges will typically ask for two types of teacher recommendations and perhaps one from your high school counselor. The teachers you ask will be those you had for core academic courses in your junior year. They may not be the ones who gave you the best grades, but those that like you and classes in which you may have made the most contribution in class or the most dramatic improvement during the year.

An important part of most college applications is often not taken seriously enough. Colleges will typically ask for two types of teacher recommendations and perhaps one from your high school counselor. The teachers you ask will be those you had for core academic courses in your junior year. They may not be the ones who gave you the best grades, but those that like you and classes in which you may have made the most contribution in class or the most dramatic improvement during the year.

Because college admissions counselors want to see the side of you in class that does not always come out in your application elsewhere, it is important to help the teacher focus on something that you did in class. Writing a thank you letter like this immediately following the teacher’s positive response to your request is a sure-fire way to get a stellar recommendation.

Of course, not all recommendations will be as powerful as this one sent in for William Smith, but send that thank you letter and you will come close. By the way, if you are a full service client, read the expanded recommendation tips in your handbook and pay attention to paragraph four of the model thank you letter.

Finally, here are five steps toward getting that stellar teacher recommendation. They support the points made above. Incidentally, if you are a junior or sophomore, you can get a preview of how many teacher recommendations you will need here. Keep them in mind if you are a current undergrad looking for professor recommendations for a job and/or graduate school. Learn now to be professional in your approach, it will serve you well.

Why Are Students Not Learning? 0

By Thomas H. Benton

Lack of student preparation. Increasingly, undergraduates are not prepared adequately in any academic area but often arrive with strong convictions about their abilities. So college professors routinely encounter students who have never written anything more than short answers on exams, who do not read much at all, who lack foundational skills in math and science, yet are completely convinced of their abilities and resist any criticism of their work, to the point of tears and tantrums: “But I earned nothing but A’s in high school,” and “Your demands are unreasonable.” Such a combination makes some students nearly unteachable.

Grade inflation. It has become difficult to give students honest feedback. The slightest criticisms have to be cushioned by a warm blanket of praise and encouragement to avoid provoking oppositional defiance or complete breakdowns. As a result, student progress is slowed, sharply. Rubric-driven approaches give the appearance of objectivity but make grading seem like a matter of checklists, which, if completed, must ensure an A. Increasingly, time-pressured college teachers ask themselves, “What grade will ensure no complaint from the student, or worse, a quasi-legal battle over whether the instructions for an assignment were clear enough?” So, the number of A-range grades keeps going up, and the motivation for students to excel keeps going down.

Student retention. As the college-age population declines, many tuition-driven institutions struggle to find enough paying customers to balance their budgets. That makes it necessary to recruit even more unprepared students, who then must be retained, shifting the burden for academic success away from the student and on to the teacher. Faculty members can work with an individual student, if they have time, but the capabilities of the student population as a whole define the average level of rigor that is sustainable in the classroom. At some institutions, graduation rates are so high because the academic expectations are so low. Failing a lot of students is a serious risk, financially, for the college and the professor.

Student evaluations of teachers. Although a lot of emphasis is placed on research on the tenure track, most faculty members are not on that track and are retained on the basis of what students think of them. The common wisdom, for the untenured, at least whether it is true or not is to find ways to keep the students happy: Expect little, smile a lot, gesture freely, show movies, praise them constantly, give high marks, bring cookies on evaluation day. Wise administrators may read confidential evaluations in context, but students can now use the Internet to retaliate against professors in ways that can damage their ability to sustain minimal enrollments in their classes.

Enrollment minimums. Students gravitate to lenient professors and to courses that are reputedly easy, particularly in general education. Some students may rise to a challenge; many won’t. They’ll drop, withdraw, or even leave a college that they find too difficult. If you are untenured and your courses do not attract enough students, then you can become low-hanging fruit for nonrenewal. If you are tenured, then it means being “demoted” to teach service courses. In such contexts, the curriculum populated by electives and required courses competing for the lowest expectations is driven increasingly by student demand rather than by what a community of scholars believes undergraduates should know.

Enrollment minimums. Students gravitate to lenient professors and to courses that are reputedly easy, particularly in general education. Some students may rise to a challenge; many won’t. They’ll drop, withdraw, or even leave a college that they find too difficult. If you are untenured and your courses do not attract enough students, then you can become low-hanging fruit for nonrenewal. If you are tenured, then it means being “demoted” to teach service courses. In such contexts, the curriculum populated by electives and required courses competing for the lowest expectations is driven increasingly by student demand rather than by what a community of scholars believes undergraduates should know.

Lack of uniform expectations. It is impossible to maintain high expectations for long unless everyone holds the line in all comparable courses and we face strong incentives not to do that. A course in which the professor assigns a 20-page paper and 200 pages of reading every week cannot compete with one that fills the same requirement with half of those assignments. Faculty members cannot raise expectations by themselves, nor can departments, since they, too, are competing with one another for enrollments.